When you sell a home in the San Francisco Bay Area, there are two major closing costs you will encounter: sales commission and transfer tax.

Sales commission is the agreed-upon amount paid to the agents and brokers involved in your real estate transaction. Commission paid by a San Francisco home seller goes towards property marketing and multimedia, administrative staff, management of the transaction and vendors, as well as your agent’s time, strategic counsel, and negotiation expertise.

Transfer tax in San Francisco is a bit more obscure, yet even more common than commission. (You can sell without a listing agent—though we do not recommend it—whereas transfer tax MUST be paid to transfer title upon the sale of a property.)

If you plan to sell a home in San Francisco, or buy a home in San Francisco and sell it later, you can count on paying transfer tax.

So, what is transfer tax, who is responsible for paying it, and what transfer tax rate should you expect in San Francisco and other California counties? Read on for all you need to know about transfer tax in the SF Bay Area.

Transfer tax is the transaction fee imposed by the City or County on the transfer of land or real property from one person (or entity) to another. In other words, transfer tax is the local government’s cut when you sell a property.

Like your yearly installments of property tax, transfer tax is another fact of life for San Francisco homeowners. Whether you sell a single-family Victorian in Noe Valley, a luxe condo in Pacific Heights, a modern loft in South Beach, a TIC in Mission Dolores, or a fixer-upper in Bernal Heights, each of these transactions will incur transfer tax.

On the bright side (and unlike property tax), transfer tax is only imposed on the sale and transfer of property title. Rather than coming directly out of your pocket, transfer tax can be paid via the sale proceeds during escrow.

In most cases, the seller of a property pays the transfer tax in San Francisco.

That said, transfer tax is negotiable like many other pieces of a real estate deal. The participants of a transaction can negotiate that the buyer will pay some or all of the transfer tax if they desire. However, it’s more common for buyer concessions to involve a higher purchase price, faster closing, and/or fewer contingencies, rather than assuming some or all of the transfer tax.

There is one big exception. In the case of new construction housing, the buyer typically pays the transfer tax. When you buy a new-build property in San Francisco, you will be responsible for title and escrow fees, lending fees if you are financing the purchase, and the transfer tax amount.

Transfer tax in California varies from county to county, or city to city in some cases.

In San Francisco proper, transfer tax rates are adjusted on a sliding scale based on the sale price of the property or its fair market value. Here are the current transfer tax rates in San Francisco:

| Entire Value or Consideration | Transfer Tax Rate in SF |

| More than $100 but less than or equal to $250,000 | $2.50 for each $500 or portion thereof |

| More than $250,000 but less than $1,000,000 | $3.40 for each $500 or portion thereof |

| $1,000,000 or more but less than $5,000,000 | $3.75 for each $500 or portion thereof |

| $5,000,000 or more but less than $10,000,000 | $11.25 for each $500 or portion thereof |

| $10,000,000 or more but less than $25,000,000 | $27.50 for each $500 or portion thereof |

| $25,000,000 or more | $30.00 for each $500 or portion thereof |

Instead of crunching the numbers yourself, you can visit the San Francisco Assessor’s website for their handy San Francisco Transfer Tax Calculator (halfway down the page) to determine what you will owe when you sell.

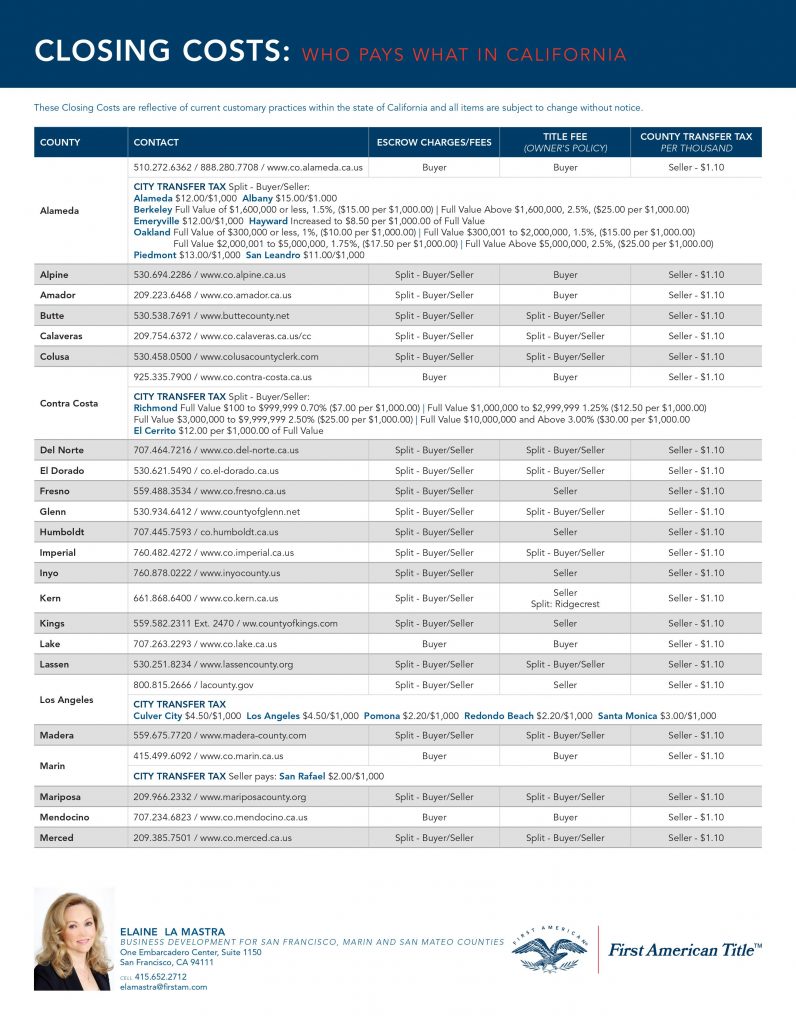

What about the transfer tax rate in neighboring Bay Area counties? SF County neighbors Alameda and Contra Costa each have their own city-by-city or sliding-scale rate calculations, and all Bay Area counties are a bit different.

You can see the transfer tax rate for every California county in this helpful chart provided by our friends at First American Title.

[Click here for the full California Transfer Tax PDF]

[Click here for the full California Transfer Tax PDF]

Not every transfer of property title requires transfer tax to be paid. The SF Assessor has listed some common questions which we’ll share below for your convenience.

Do These Common Types of Transfers Cause a Transfer Tax?

Taxes are not the most thrilling part of real estate, but they come with the territory. If you are concerned about taxes and other closing costs related to selling your home, the best thing you can do is work with an experienced, well-regarded team with a proven track record of success.

At Danielle Lazier Real Estate and Vivre Real Estate, our boutique team of full-time agents and marketing professionals works collaboratively with San Francisco Bay Area home sellers to prepare properties for sale with staging and other high-ROI improvements, strategically list and market homes at the right price for the local market, and close the deal through skilled negotiations making sure you don’t leave money on the table.

The best way to mitigate closing costs and transfer tax is to get the most money from your home in a smooth, efficient, and enjoyable real estate process! If you’d like to learn more about how our top 1% team of San Francisco Realtors can help, or if you have any questions about taxes or other real estate topics, please don’t hesitate to contact us today. We are always happy to hear from you!

Sign up for the Vivre Real Estate newsletter for a twice-monthly, info-packed update on San Francisco real estate, local insights, events, culture, and more. We never share or sell your information.