In this San Francisco Real Estate Market Update for September 2021, we cover the performance of house, condo and rental market segments, compare the past 12 months of San Francisco home sales with the previous 12 months, examine the factors behind San Francisco's real estate market recovery, and compare 2021 market seasonality with previous years.

The general belief among economists is that various types of housing (single-family homes, condos, apartment or home rentals, etc) should reach an equilibrium.

If that's the case, then why is San Francisco real estate still all over the place?

Since the start of the pandemic, results have varied widely:

However, each housing type has experienced a similar level of recovery since the market bottom in December 2020:

In terms of recovery, the delta between the best- and worst-performing sectors is only 6%, rather than a 30% difference as measured from before the pandemic.

These stats reflect how consumer tastes shifted when the pandemic hit. Due to shelter-in-place, homebuyers wanted outdoor space, bigger floor plans, and extra rooms for at-home work and schooling. These factors combined with historically low mortgage rates drive demand for single-family homes, even in the height of the pandemic.

Across all price ranges, from under $1 million to over $5 million, home sales skyrocketed in the past 12 months.

Compared to the period of August 2019 to August 2020, the last 12 months saw:

The biggest "winners" among these San Francisco real estate market segments were the ultra-luxury market and the lower end of the market.

The big rise in homes sold for under $1MM reflects the dramatic jump in condo sales after inventory soared and prices dropped in the early days of the pandemic.

Even more dramatic was the rise in ultra-luxury home sales of $5MM and up. A number of factors were involved, which we'll dig into below.

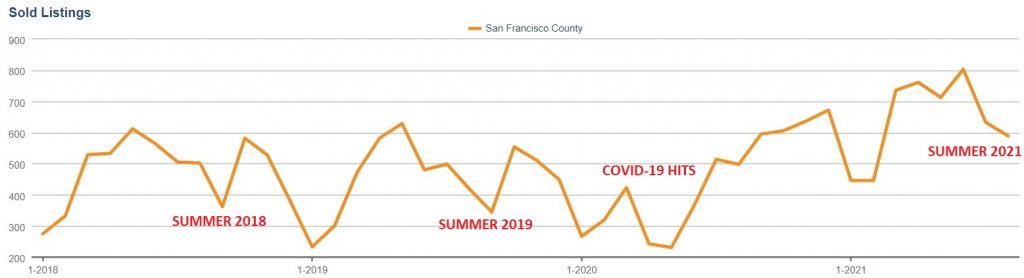

Real estate markets around the country, including in San Francisco, tend to follow seasonal trends.

In 2018 and 2019, closed sales hit their lowest point in September. (Closed sales lag roughly one month behind pending sales, so the fewest deals were made in August.)

Of course, 2020 threw everything off kilter. San Francisco home sales fell sharply in the usually busy spring season, and pending deals ultimately peaked in December which started 2021 with a boom in closings. A very unusual end to a very unusual year.

Now in 2021, we appear to be back on track with typical real estate seasonality. Except this "summer slowdown" was still far busier than in previous years.

If seasonal trends continue, we can expect a busy fall selling season with more homes hitting the market and more options for buyers.

We hope this August real estate market update for San Francisco will help you in planning your next move or investment.

If you have questions about the market or your next steps to buying or selling, let us know! We’re always happy to help you and anyone you send our way.

If you are considering selling a home in San Francisco, fill out our Seller Worksheet to tell us more about your situation.

If you want to buy a home in San Francisco, tell us your goals and timeframe in our Buyer Worksheet. Or send us a message with any general inquiries.

Want to stay up to date on San Francisco real estate?

Sign up for our twice-monthly email newsletter to get information and insights delivered straight to your inbox. We never sell or share your information.