If you're trying to understand the San Francisco housing market, the first thing to know is that it doesn't really exist.

Reading a Substack by housing expert Jonathan Miller - There Is No National Housing Market - in which he explains why national real estate headlines are not relevant on a local level, I was reminded of two things:

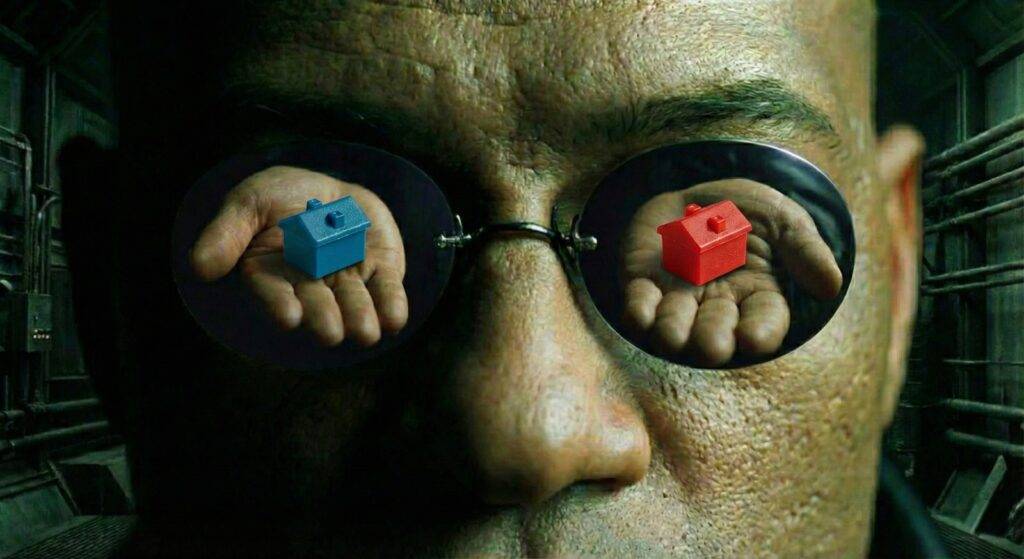

First, the Matrix, because of this quote from the spoon-bending kid: “Do not try and bend the spoon. That's impossible. Instead, realize the truth: there is no spoon. Then you'll see it is only yourself that bends.”

Second, San Francisco real estate, because there’s not really a “San Francisco housing market” either.

The San Francisco real estate market is not a single entity. It is made up of many small markets. These “micro-markets” include various neighborhoods, price ranges, and types of property. A buyer’s or seller’s experience can change completely depending on the specific area or property type they are dealing with, even if other factors are the same.

When you take the “real estate red pill” (to borrow another Matrix metaphor), you stop seeking a full, holistic view of the market and instead embrace the fact that every situation, from the property to the person, is unique.

Recently, the big story in San Francisco real estate has been the burst of housing demand from the AI boom. An influx of capital and high-earning AI workers has given the city the highest increase in rent prices and the fastest-selling homes of any major US metro.

This is a major shift from the “doom loop” narrative of a few years ago (which are now trending positively for a number of non-real-estate reasons too). It’s also not the whole story.

In reality, the new AI-driven demand has been unevenly distributed across San Francisco real estate. Wealthy tech workers are buying higher-priced properties, fueling demand for luxury homes in specific areas.

Once you start peeling back the layers, you find a city of many micro-markets, each with its own trends and quirks.

The San Francisco neighborhood you’re looking at changes the picture dramatically. Take condos as an example:

That's a 12-point swing between two neighborhoods you can walk between in 15 minutes.

Data: 12-month rolling average, Jan 2025 to Jan 2026, via SFARMLS/Infosparks.

Property type matters just as much as location. Condos in general have not recovered from the rate-hike slowdown in the way that single-family homes (houses) have.

Here’s how the 12-month sale price in January 2026 compares to all-time highs:

Both condo peaks were in the second half of 2017, meaning those markets have been working to recover for the better part of a decade. Meanwhile, selling a house in San Francisco has nearly returned to peak pricing.

It’s not just the price. The speed of a sale tells you a lot about supply, demand, and competition in a given San Francisco micro-market.

If you listed a house last fall in certain neighborhoods, it moved fast:

If you listed a condo in other parts of the city, the timeline looked very different:

It’s important to mention that 45 days is a perfectly “normal” timeframe to sell a home, historically speaking. Thirteen days is lightning fast. Nonetheless, this gap highlights just how different these micro-markets really are.

Unsurprisingly, the difference in supply, demand, and competitiveness shows up in what sellers actually receive compared to what they list.

From lowest to highest, here are the three-month rolling average stats from last fall (Sept to Nov 2025):

| Neighborhood | % of Listings Sold Above Asking | Avg. Sale-to-List Price |

| SoMa | 23% | 97.7% |

| Russian Hill | 38.5% | 110% |

| Noe Valley | 40% | 117% |

| Bernal Heights | 50% | 120% |

Citywide, over 80% of single-family homes sold above asking price last fall, compared to 43% of condos. A house in Bernal Heights is facing a completely different market than a condo in SoMa.

Price, speed, overbidding: there are a million ways to slice it. And that’s the point. San Francisco real estate is hyper-local, such that local articles aren’t digging deep enough to tell the full story that is personally relevant to you. National publications, even less so.

Beyond the neighborhood, your property’s condition, specific location, features, views, and upgrades all play a role.

And then there’s you: your personal situation, your motivations, your goals, your timeline. Each of these factors shapes the outcome of buying a home in SF or selling a home in ways that a market-wide headline simply can’t capture.

That’s the complex, high-stakes reality behind every home sale in San Francisco. And it’s a really good reason to hire the best SF real estate agents for the job! 😉

SF real estate is complicated, expensive, and deeply personal. At Danielle Lazier + Vivre Real Estate, we’ve built our career and reputation on intelligent, personal advice to help you navigate these questions and optimize your results with the least amount of stress.

In addition to smart strategy and a proven process, we specialize in the soft skills that influence outcomes: communications, negotiations, overcoming obstacles, personal guidance, professional networks, and insider info, to name a few. We have been top 1% SF Realtors since 2002, helping our neighbors to navigate San Francisco’s many markets. You can read some of their stories in our case studies.

So… forget the spoon! Forget the monolithic “San Francisco housing market.” Once you stop trying to fit the city into a neat and tidy narrative, things get a lot clearer. You can start making decisions based on your reality, not some headline.

Ready to explore what SF real estate means for you? Contact us today. We’d love to learn about your personal situation and see if we're a good fit to help.

And if you want to stay in the loop on SF real estate trends and news, sign up for our newsletter. We value your privacy, no spam or games.

Looking for a trusted team to help you buy and/or sell a home in San Francisco? Reach out to us today. We'd love to help.