The SF real estate market is heating up fast:

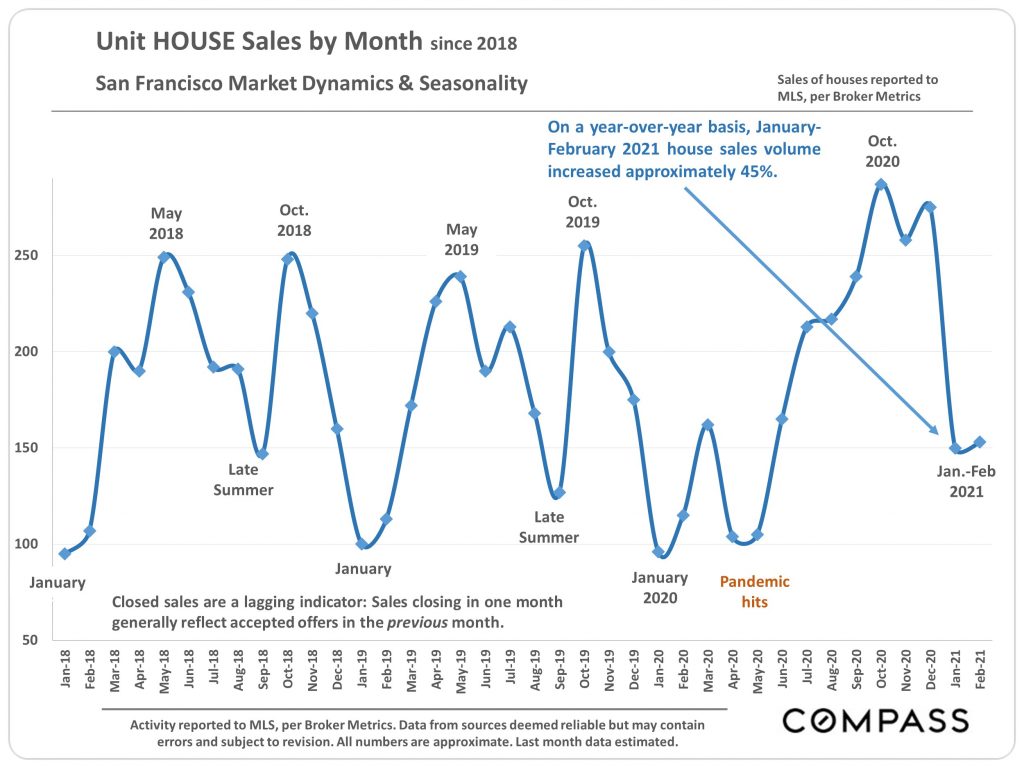

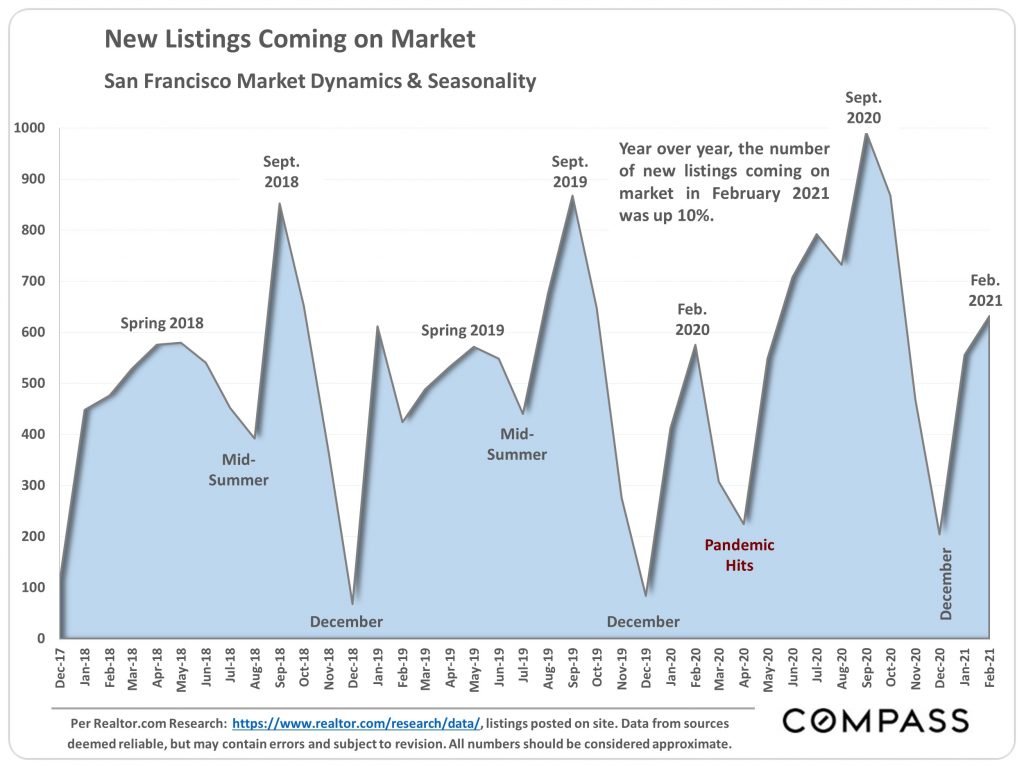

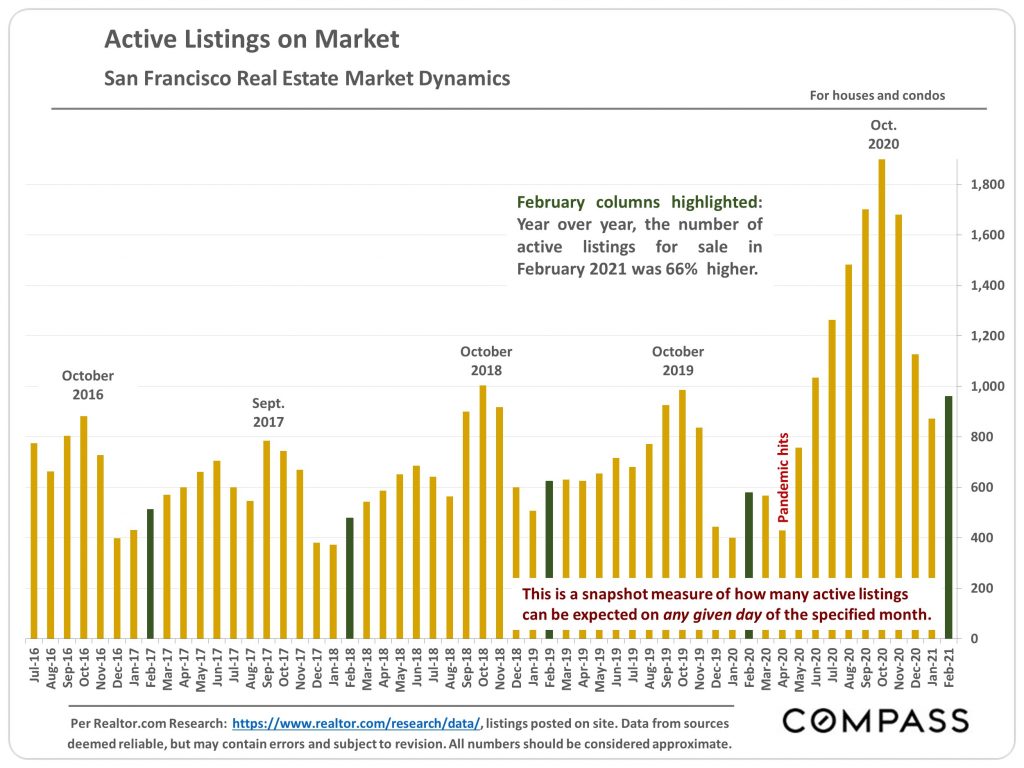

At the beginning of the new year, it is not unusual for buyers (demand) to jump back in much sooner than sellers (new listing supply), a dynamic which commonly accelerates as spring gets underway. When demand surges while new listings lag behind, buyers must increasingly compete, often heatedly, for appealing homes.

This imbalance in supply and demand adds considerable pressure to the market, with overbidding and price increases becoming much more common. And this has occurred with a vengeance in early 2021, especially within the city's single-family home market.

This report will look at median house and condo list and sales prices, supply and demand from a variety of angles, the surge in luxury home sales, home prices along the Bay Area coast, and the recent jump in interest rates.

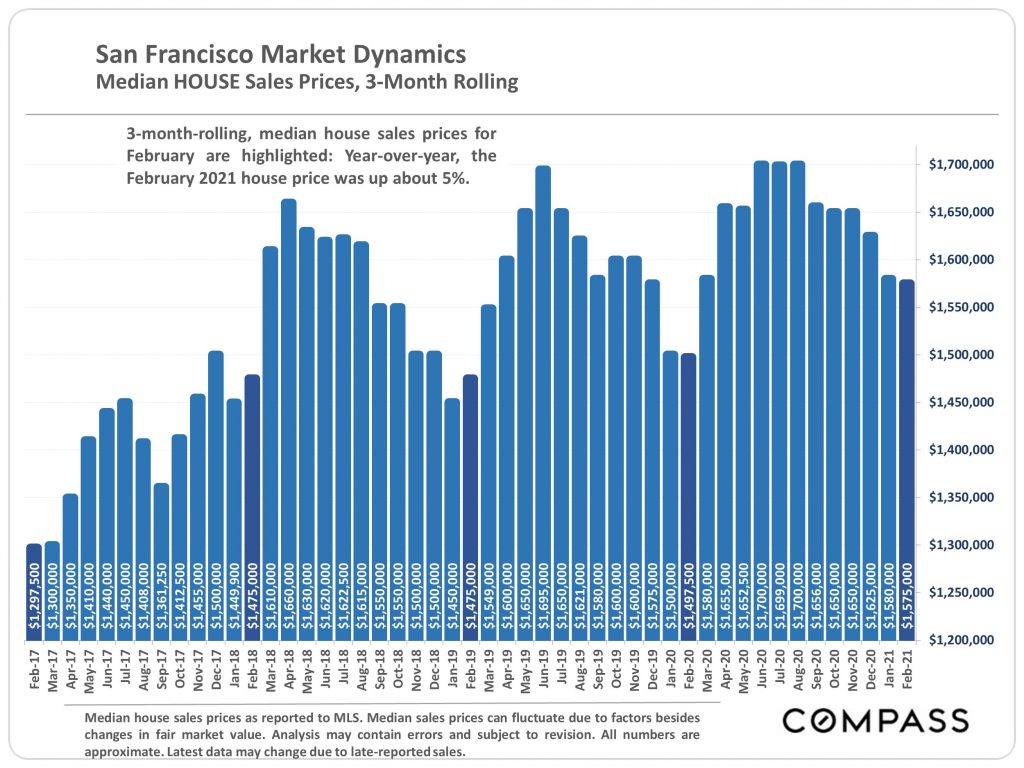

Home values struggled to break through historic highs last year, but 2021 is off to a strong start with February sale prices up about 5% year-over-year.

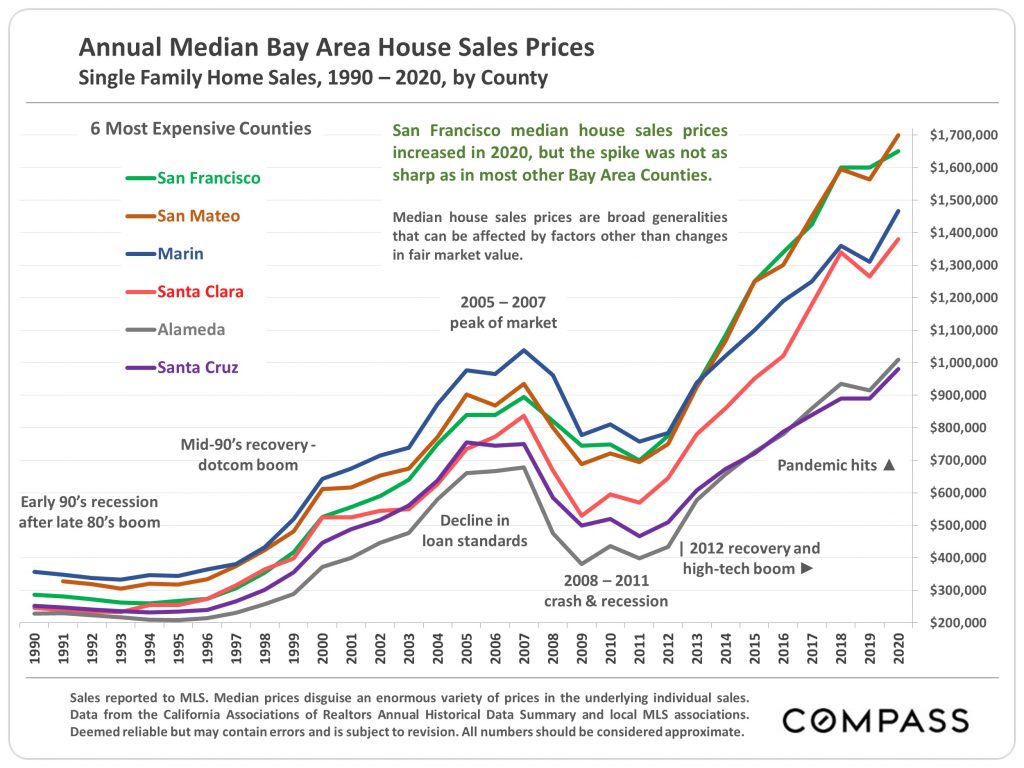

San Francisco median single-family sale prices did go up last year, but not as sharply as in some Bay Area counties.

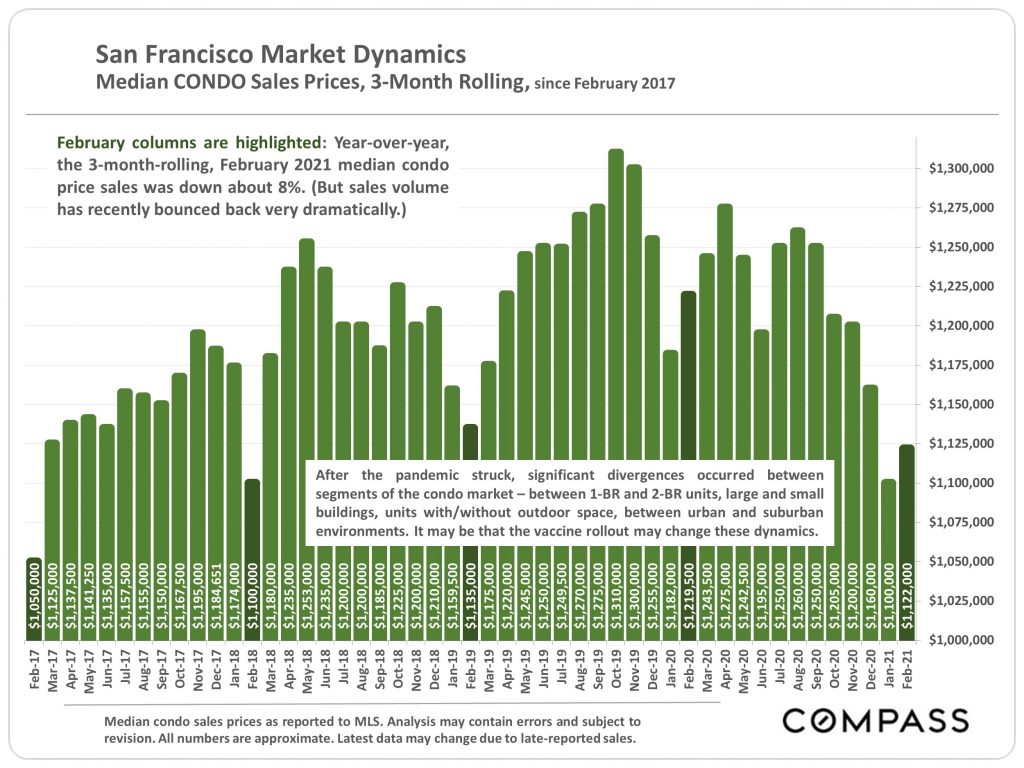

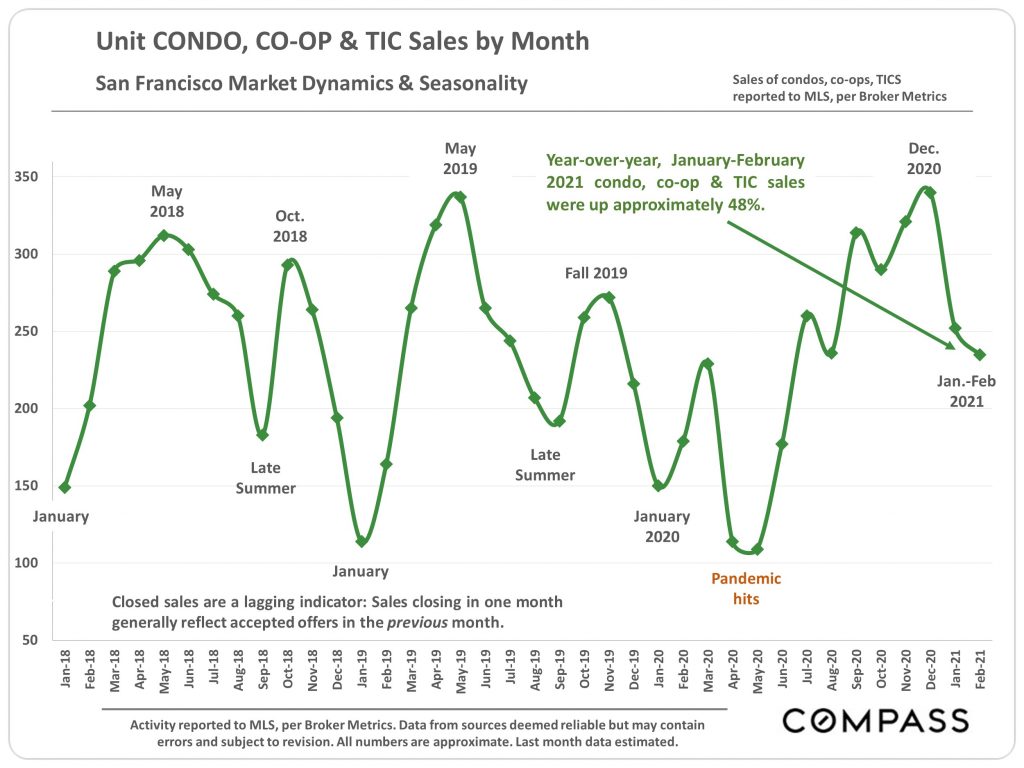

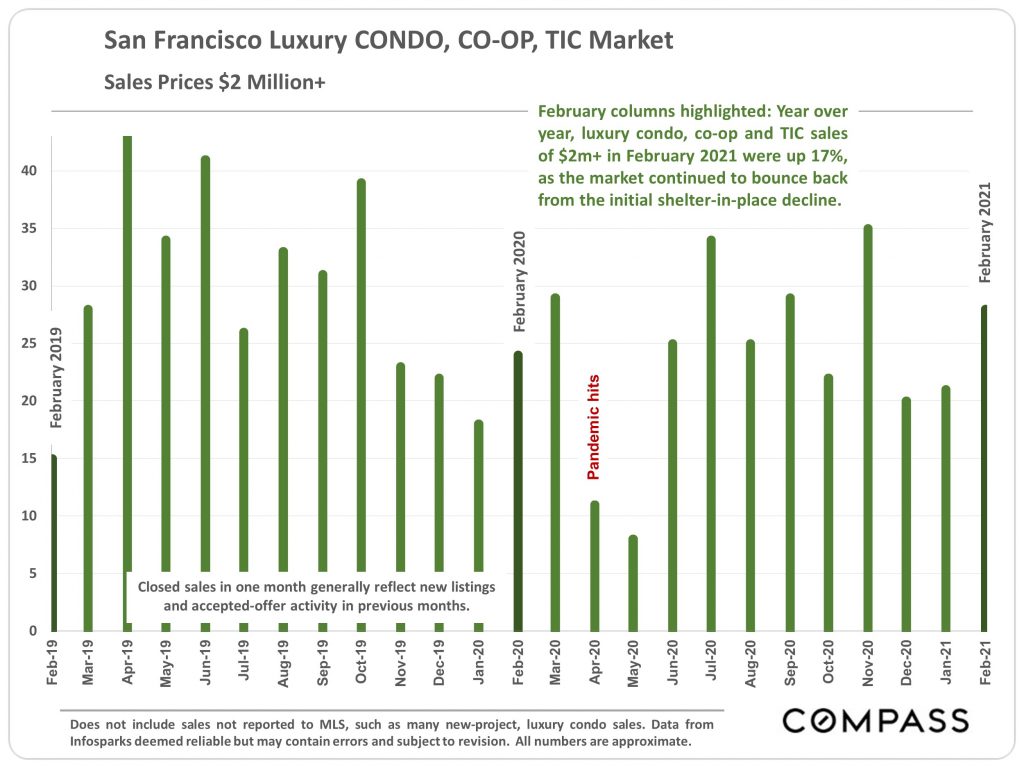

San Francisco condo sales prices are still fighting their way back after last year's slump, but sales volume has made a dramatic comeback, showing the demand is there. The pandemic caused a sharp divergence between segments of the condo market.

Year-over-year, single-family home sales volume increased about 45% in the first two months of 2021. The spring market sprung early.

Similarly, condo/co-op/TIC sales increased 48% year-over-year in the first two months of 2021.

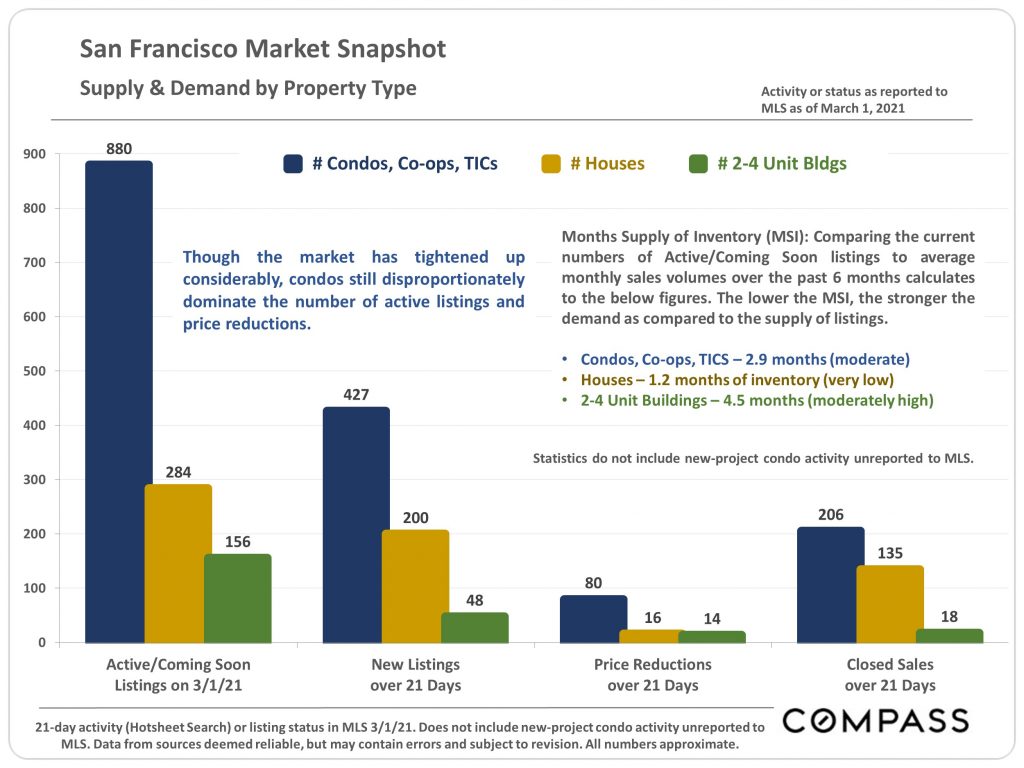

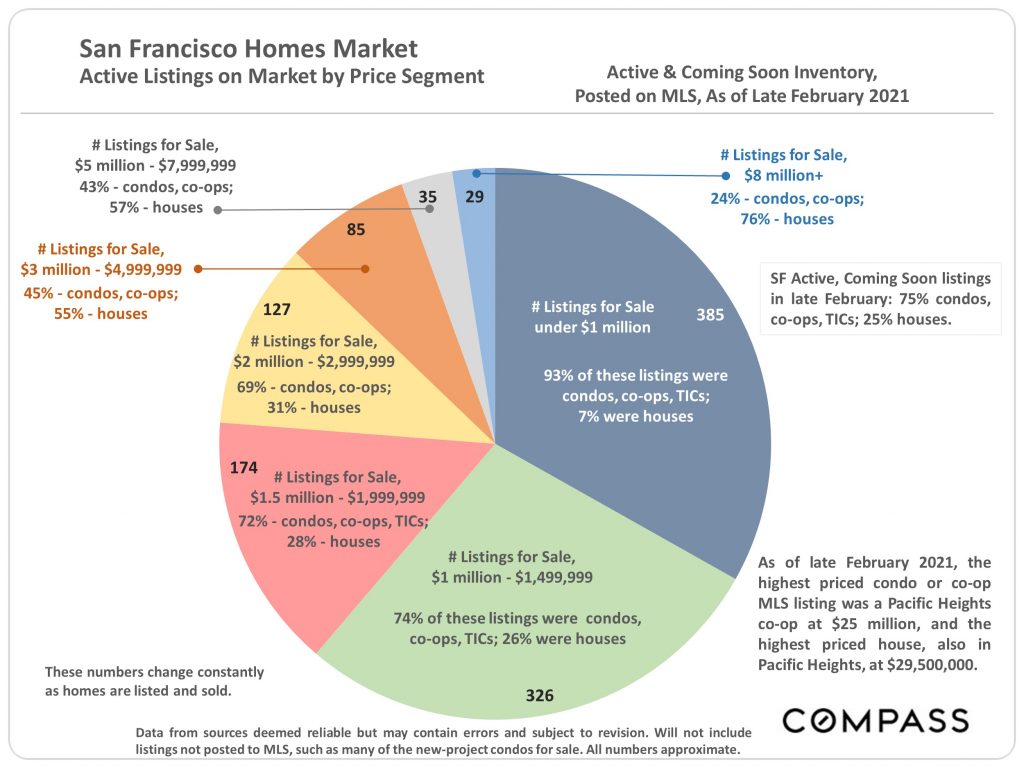

Listing supply is down across the board, but condos are still lagging behind single-family homes in this tight market.

New listings increased 10% year-over-year last month...

...bringing the number of active listings for sale in February 2021 to 66% higher year-over-year.

A majority of currently active listings are priced below $1,499,000, and the vast majority of them are condos.

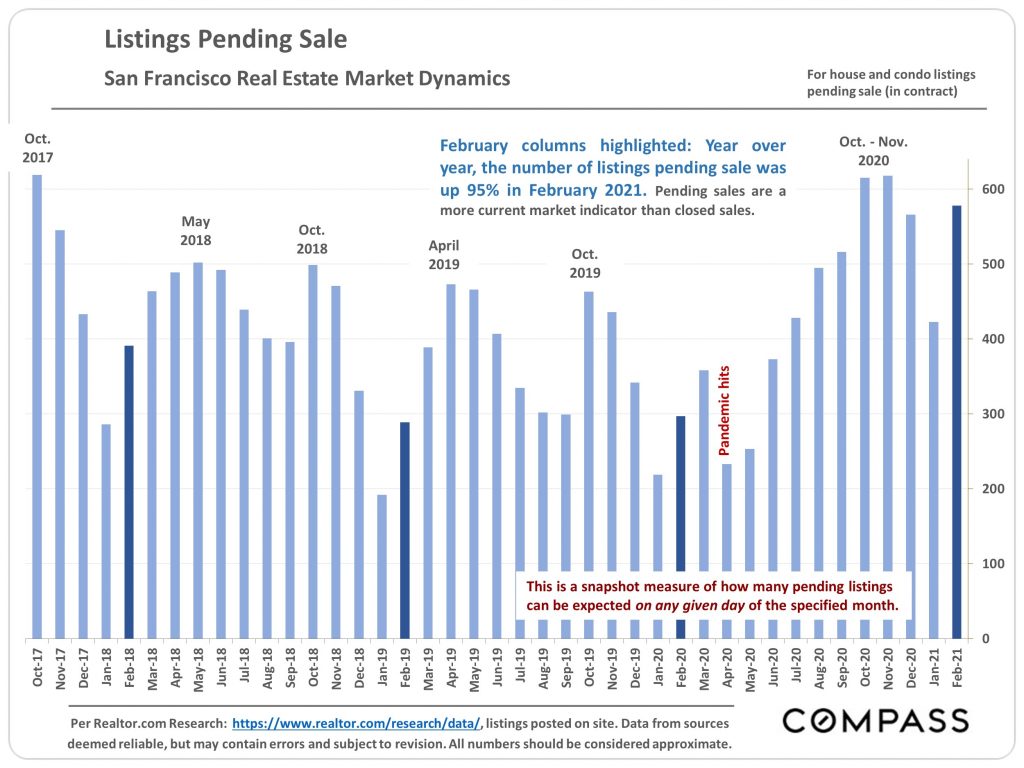

Another sign of an early, strong spring market, pending sales were up 95% year-over-year in February 2021.

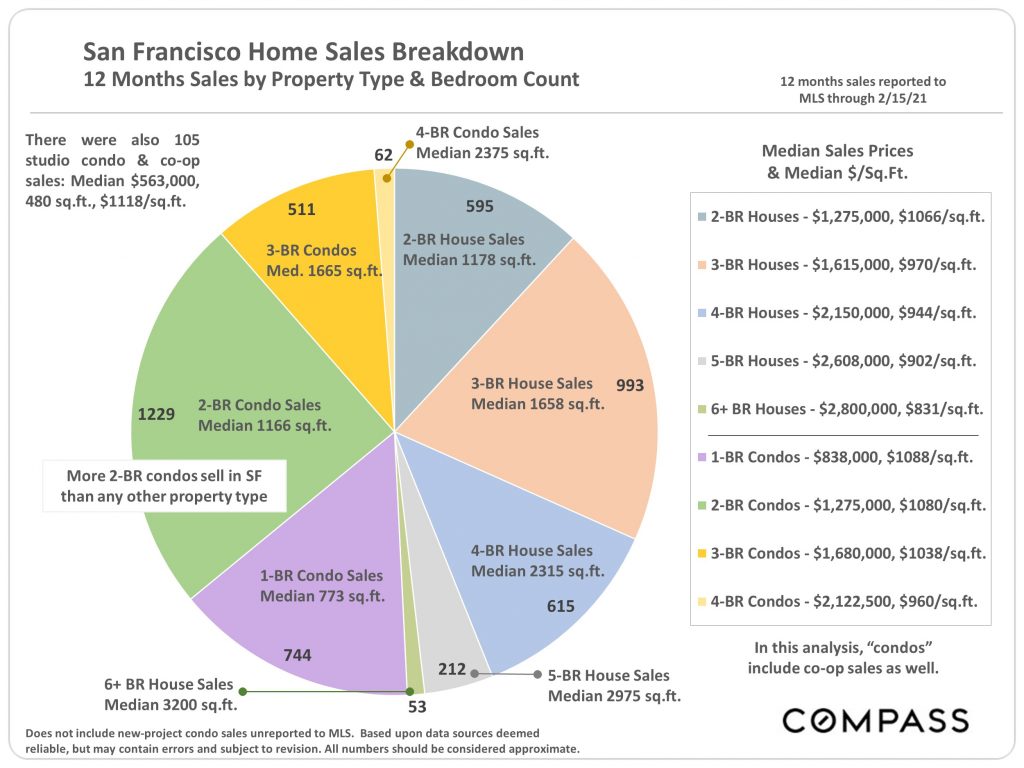

Over the past 12 months, the most commonly sold type of property were 2-bedroom condos.

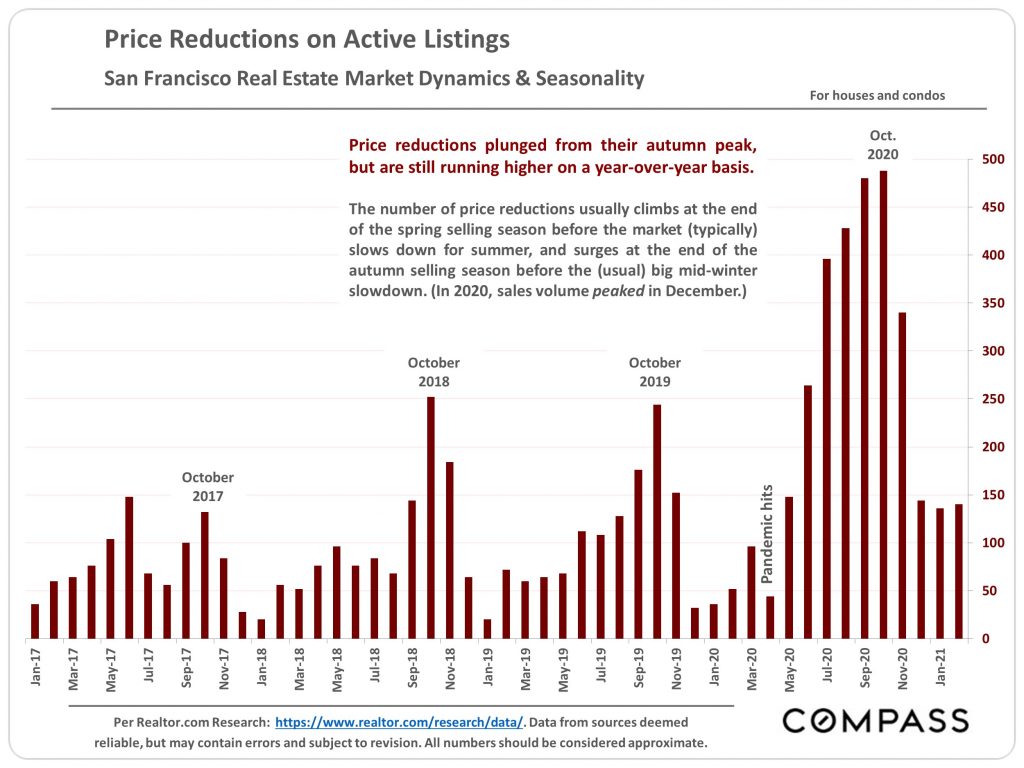

Price reductions exploded last year amidst a tumultuous market. They have fallen sharply from their autumn peak, but are still higher than normal for this time of year.

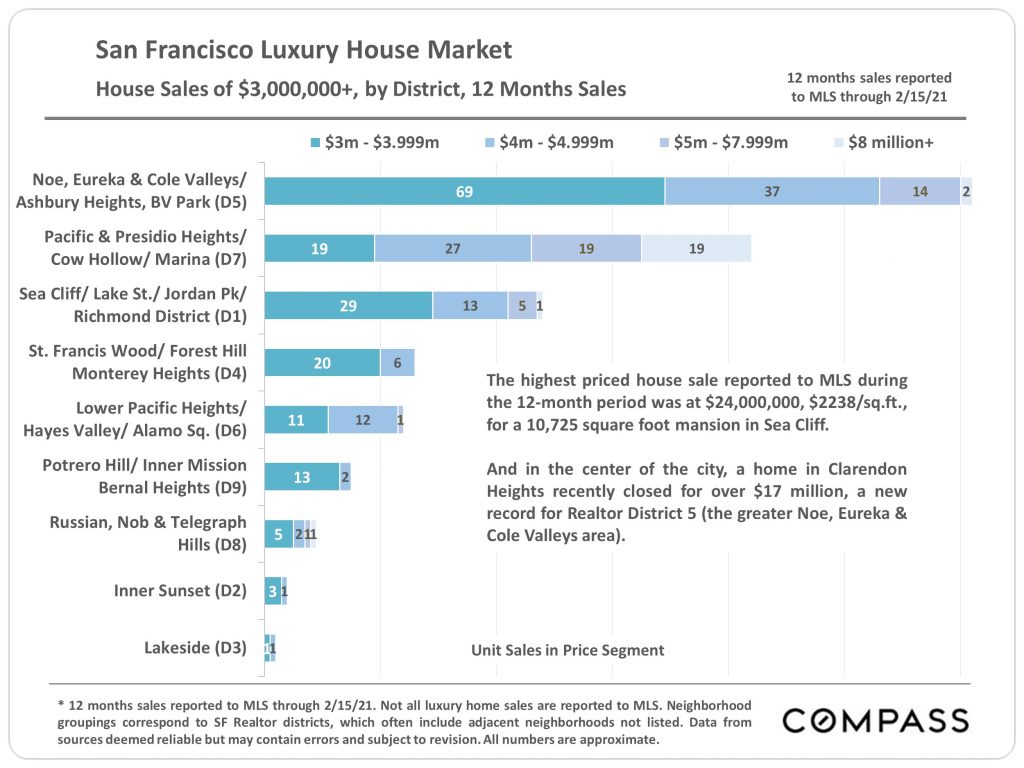

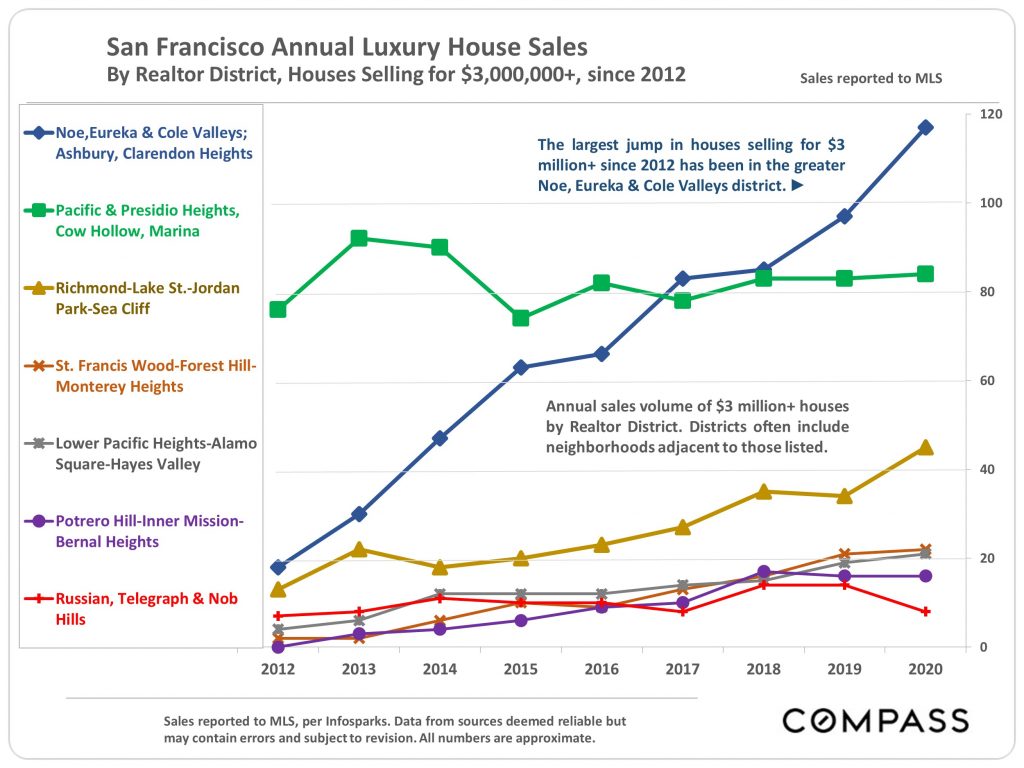

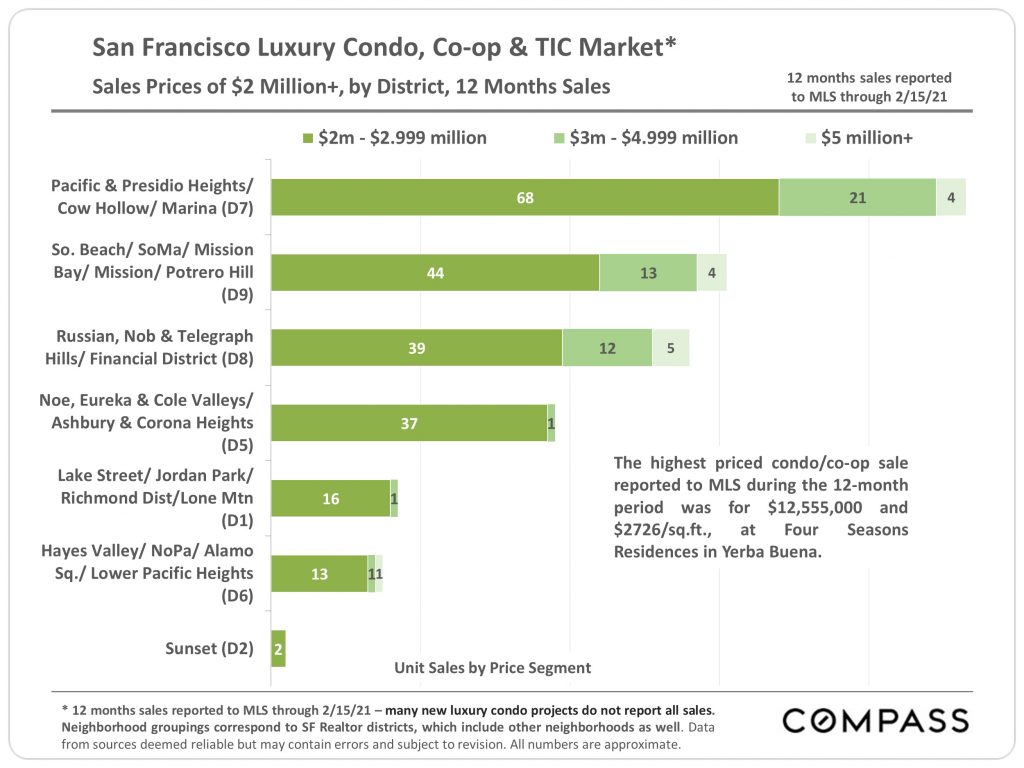

MLS Districts 5 and 7 saw the most luxury home sales above $3,000,000 over the past 12 months.

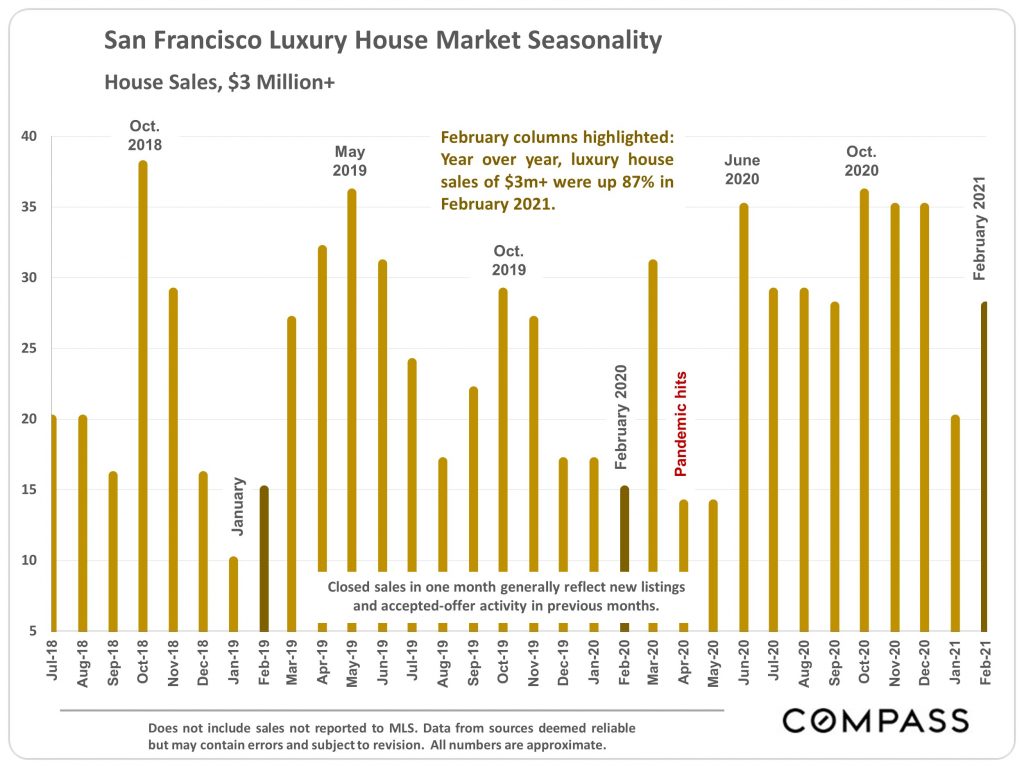

Single-family luxury home sales ($3M+) were up 87% year-over-year in February.

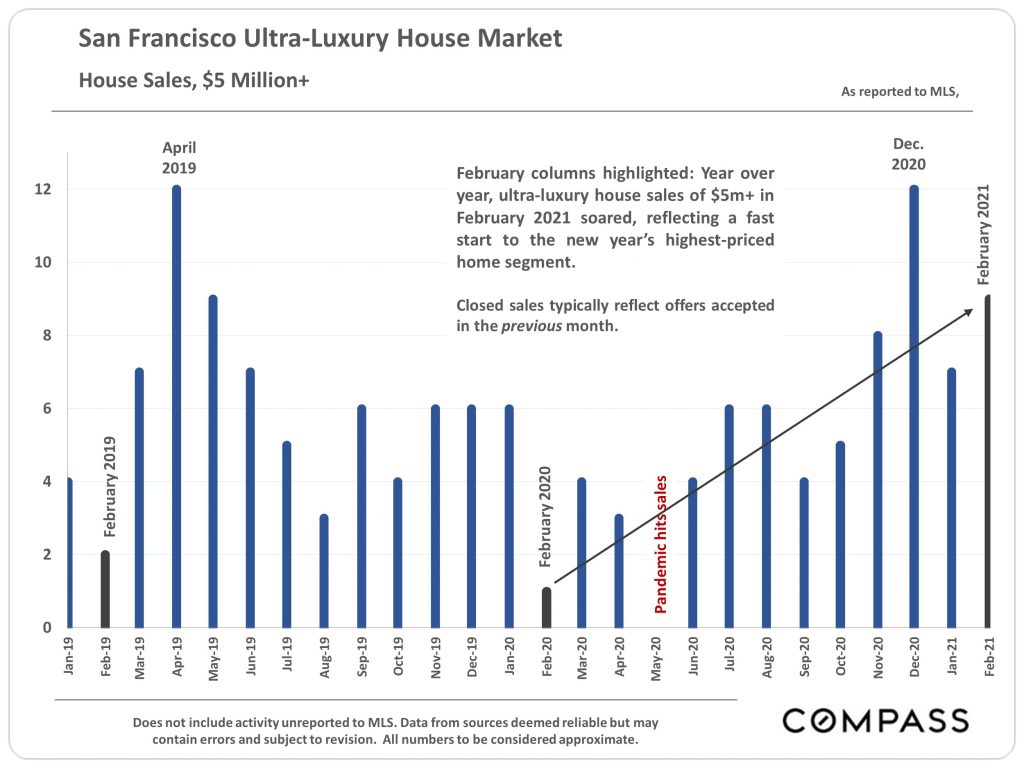

San Francisco's highest-priced segment, single-family homes over $5M, saw a huge increase in sales in the past year.

Since 2012, the largest jump in single-family homes sold above $3M occurred in MLS District 5, home to Noe Valley, Eureka Valley, Cole Valley, Ashbury and Clarendon Heights.

The highest condo sale in the past 12 months was for $12,555,000 and a whopping $2,726 per square foot, at Four Seasons Residences in Yerba Buena.

Luxury condo sales in San Francisco are continuing to bounce back, up 17% year-over-year in February 2021.

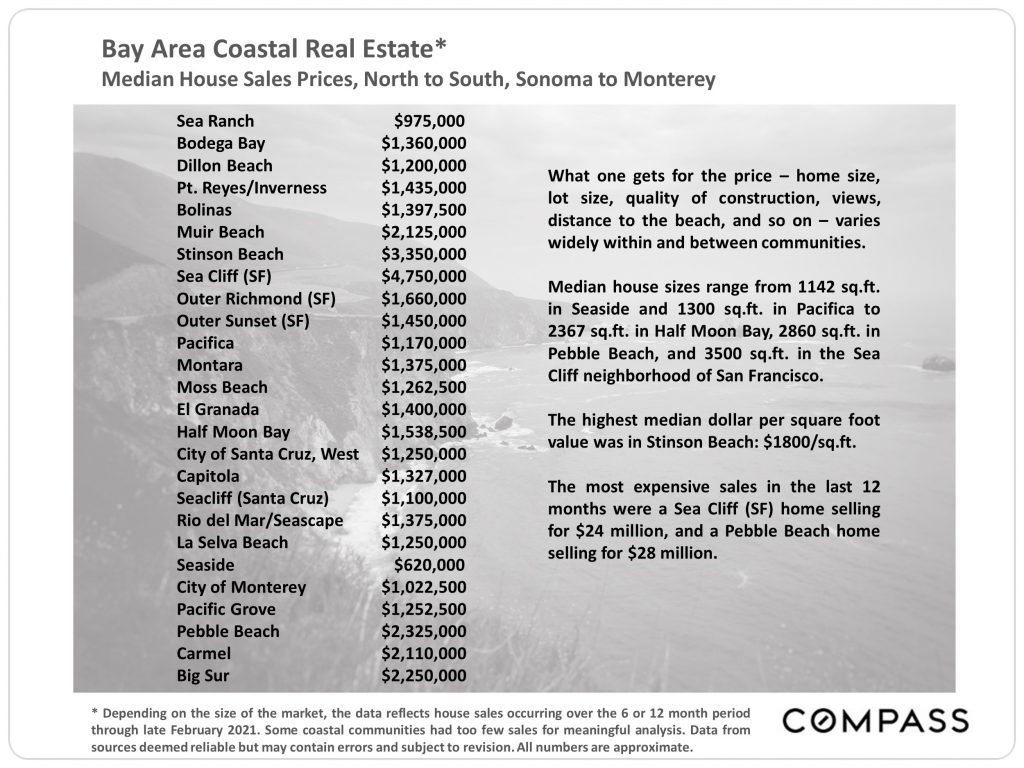

Home prices, size, lot size, quality and more vary widely among Bay Area coastal communities.

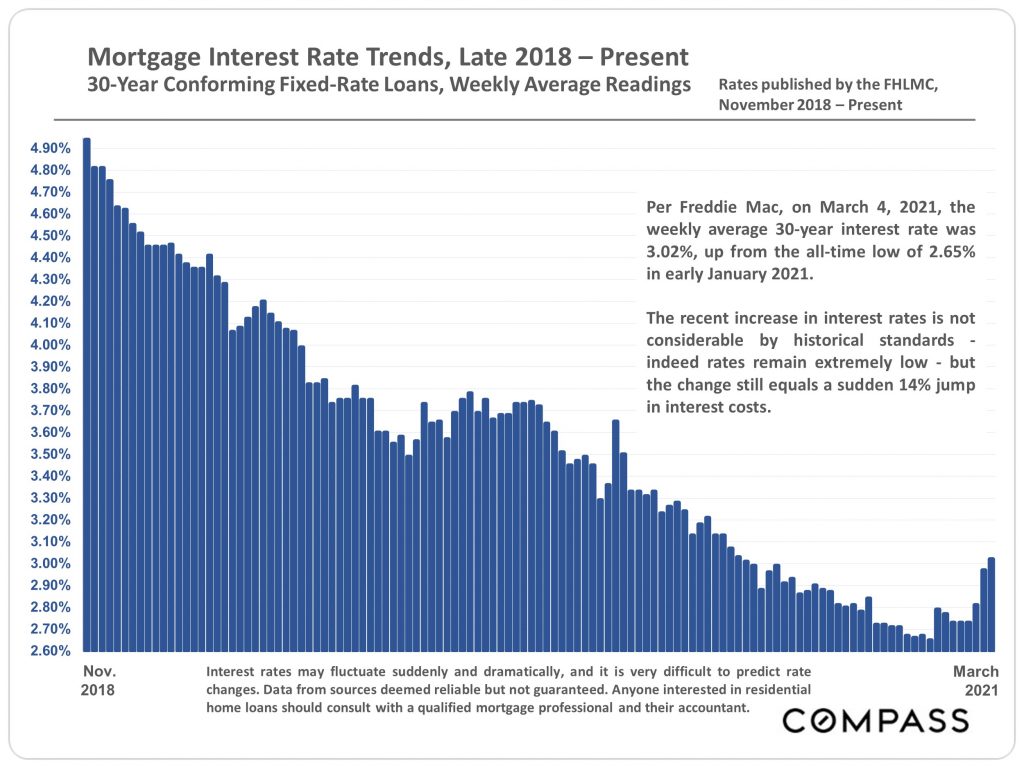

National average mortgage rates have ticked up recently, but they still remain historically low. Buyers may see this as added incentive to buy sooner than later.

We hope this SF real estate market update is helpful to you! If you have questions about SF real estate, get in touch! We're happy to hear from you.