Like all local markets, broader trends affect San Francisco real estate. Yet, history shows that our city is often an exception to the greater macroeconomic rule. At times, we are insulated from the national economy’s ups and downs. Other times, we are affected more—for better or worse.

The Bay Area was among the earliest US regions to document cases of the novel coronavirus. Local government responded with drastic countermeasures. With a California stay-at-home order in effect, the economic impact of the pandemic is already wide-ranging. Its ultimate extent remains unknown.

We can’t predict the future, but we can look to history for clues. For the last 30+ years, San Francisco real estate values have been impacted by a number of unique factors. From the 1989 earthquake to the rapid rise of Bay Area tech, we have seen higher highs and lower lows relative to the rest of the country.

National Home Price Appreciation, 1975-2019

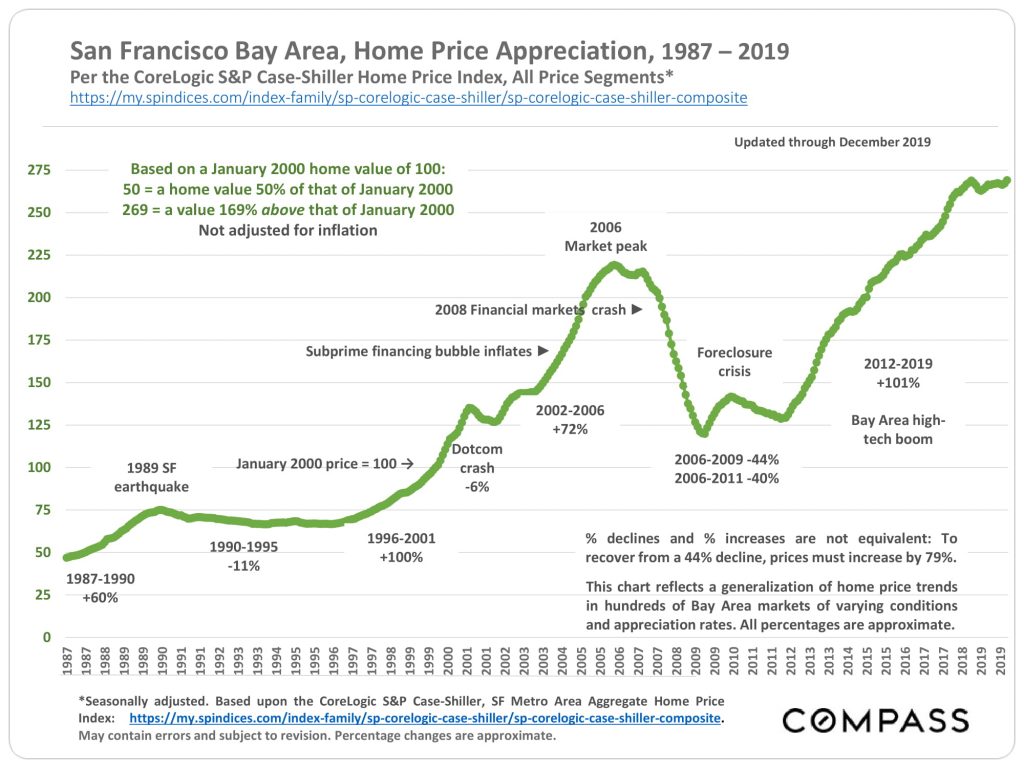

Bay Area Home Price Appreciation, 1987-2019

Graphs courtesy of COMPASS | Data per CoreLogic S&P Case-Shiller National Home Price Index

Following a recession in ‘81 and ‘82, the country bounced back strong. Home values around the country boomed between 1980-1990, gaining a total of 67% per the CoreLogic S&P Case-Shiller National Home Price Index. San Francisco home values followed suit. By the early eighties, Silicon Valley already had the highest concentration of venture capital firms in the world. Law firms were hiring left and right. Just in the years of 1987-1990, Bay Area real estate appreciated a whopping 60%.

The good times didn’t last, however, and a mild recession hit in 1990. From 1990-1991, national home values slipped 2%. Fortunately for most of the country, the slump didn’t last long. San Francisco, on the other hand, was much slower to recover. Due in large part to the 1989 San Francisco earthquake, which killed 67 and caused over $5 billion in damages, San Francisco real estate continued to slide for years. In total, San Francisco home price appreciation dropped 11% between 1990 and 1995.

The mid-90s were a turning point for San Francisco real estate values. The Bay Area had long been a cradle of innovation, starting in the 19th century with a semaphore atop Telegraph Hill which broadcast the contents of inbound ships. Don Hoefler coined the term “Silicon Valley” in 1971, and by the eighties, Apple was a household name. When the Dotcom boom hit, wealth in the Bay Area—and its home values—boomed as well.

The age of AOL created millionaires overnight. From 1996-2001, San Francisco home values doubled. Silicon Valley’s Sand Hill Road had the most coveted office space in the world. When the bubble inevitably burst, that meteoric rise turned to meteoric failure (with some extra help from gravity). Pets.com? Woof.

The Dotcom crash wiped out some of the SF home price gains from previous years, but not much: only 6%. By 2002, things were picking up again.

Contrary to the Bay Area, the national real estate market was resilient. It barely caught a whiff of the stink let off by the Dotcom bubble burst. In fact, not even 9/11 made a significant dent in national home prices. Through thick and thin, nationwide home appreciation just kept rising, growing a total of 142% between 1991-2006. San Francisco actually fared even better. In spite of the Dotcom crash, San Francisco real estate appreciated 166% in the same period. To everyone but those “Big Short” guys, things were looking pretty great.

Enter Subtimus Prime, the Decepticons’ unscrupulous mortgage lender. (He transforms into a credit default swap.) It turned out that all the people buying homes above their means could not, in fact, have it all. The financial crisis of 2007-2008 taught us many new terms like “subprime lending” and “too big to fail.” It also showed us the error of wanton deregulation. By 2011, home values fell 26% nationwide and an even worse 40% in the Bay Area.

What did we learn from the subprime crisis? The effects of a crisis are not evenly dispersed. Less affluent residents of the Bay Area were hit harder; they were the ones with subprime mortgages. Lower-end home values dropped as much as 60%. The blow was softened for luxury homes, with just a 15% decrease in value at the highest end.

While COVID-19 eagerly infects the rich and poor alike, its economic impact will be felt more acutely by the less affluent. The wealthiest San Franciscans can weather the storm. Hourly earners, blue-collar workers, and those who cannot work from home will feel the brunt of the economic blow.

Since 2012, our country has been in recovery. The stock market boomed, unemployment fell, and home values appreciated 55% nationwide by 2019. The Bay Area’s ascent was dubbed the “high tech boom,” as tech giants like Google, Apple, and Facebook shed their mortal coils to reach a higher state of transcendental valuation.

Thanks in large part to this second wave of tech money, Bay Area real estate appreciated 101% between 2012 to 2019. Rising values seemed to falter after reaching a high in 2018, but rate drops in late 2019 nudged the needle up yet again. Experts and pundits alike predicted a roaring spring real estate market for 2020. That didn’t go quite as planned.

So that leaves us where we stand today. Before the coronavirus, before shelter-in-place, we were doing alright. It’s true that real estate is a cyclical market, and we were due for a correction. But most were not expecting it to come close to the Great Recession, let alone this current situation. What will it be called? Open to suggestions.

What are the likely scenarios? The optimists call it a “V”-shape—a quick bounce back as soon as we can leave our homes and get back to business. The pessimists see more of a squiggly, upturned line—a slow recovery, each industry grasping for a hand-hold while they struggle their way back up. It is too soon to say which will occur. Anyone who says otherwise is a liar or a genius who will inevitably be played by Steve Carrell in a feature film.

We all have so much on our minds these days. You’re probably not thinking about real estate. If you are, let us know. We would welcome the distraction.

Stay safe, stay at home, and stay in touch. Figuratively, of course.