June Real Estate Market Overview:

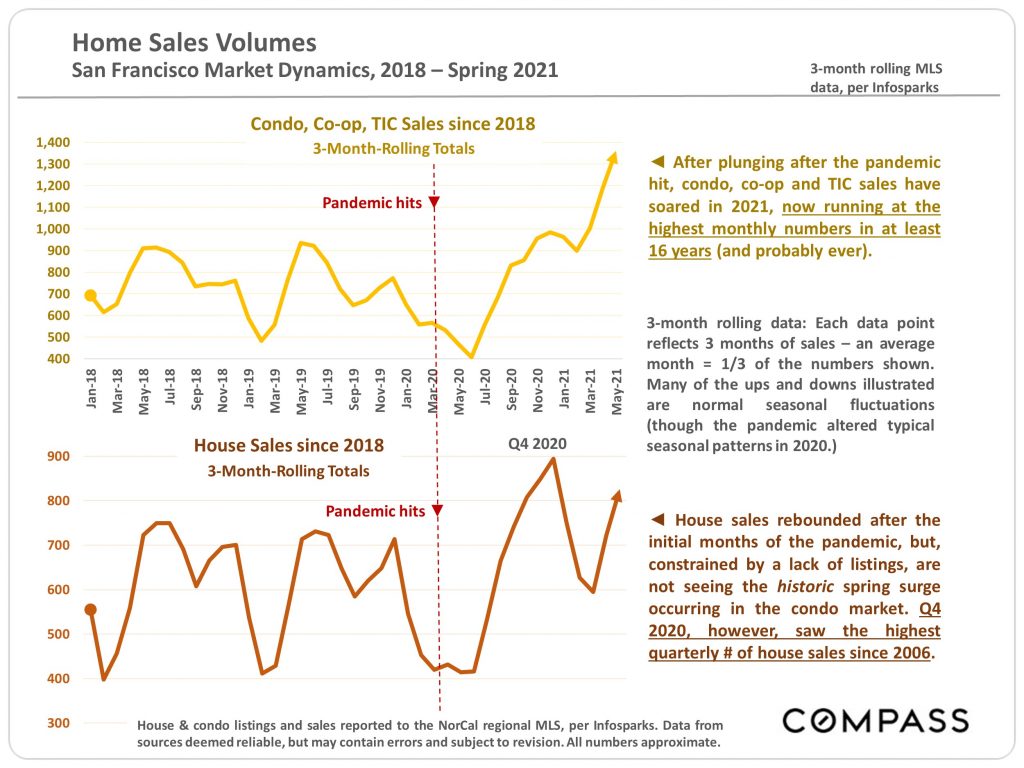

In 2021, sales of condos, co-ops and TICs have skyrocketed. Demand is also sky-high for single-family homes, but limited listing supply has dampened sales numbers.

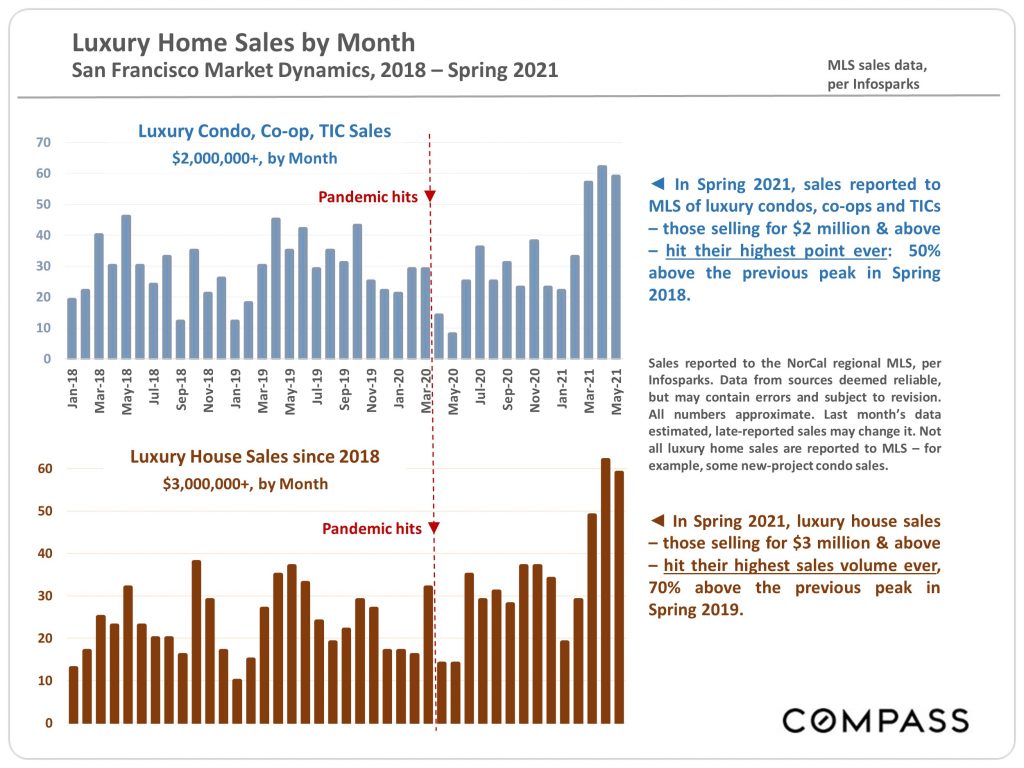

Sales of luxury condos ($2M+) and luxury single-family homes ($3M+) each hit their highest point ever in Spring 2021.

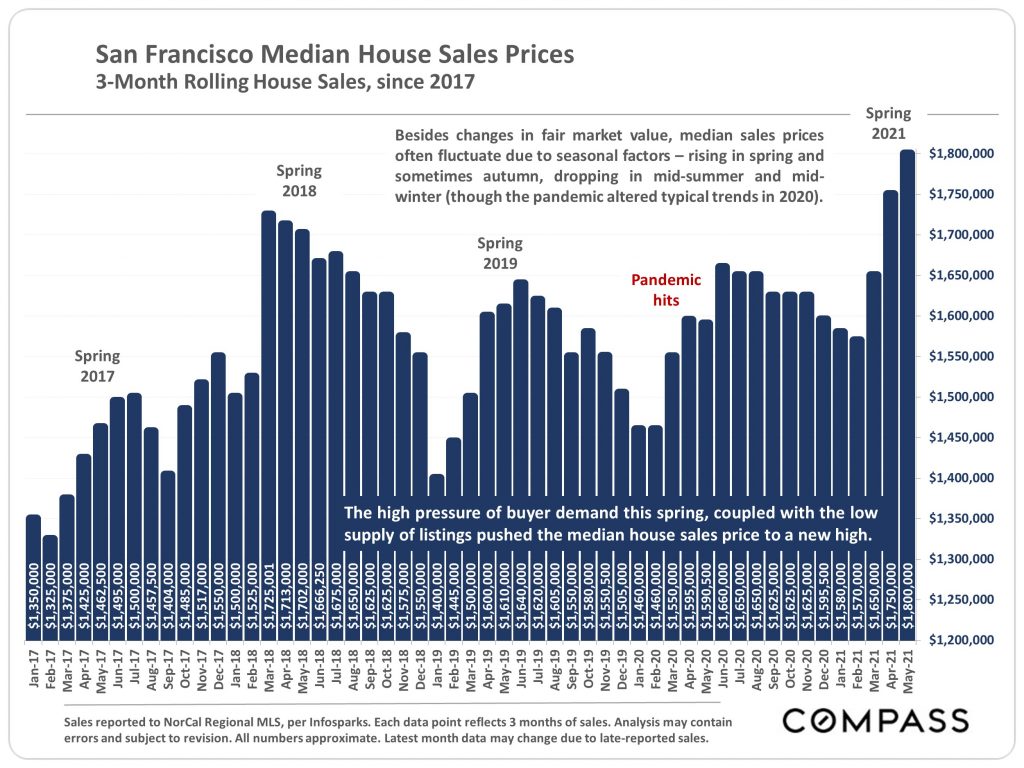

High demand and low supply leads to higher prices, as shown in the rising median sale price of San Francisco single-family homes.

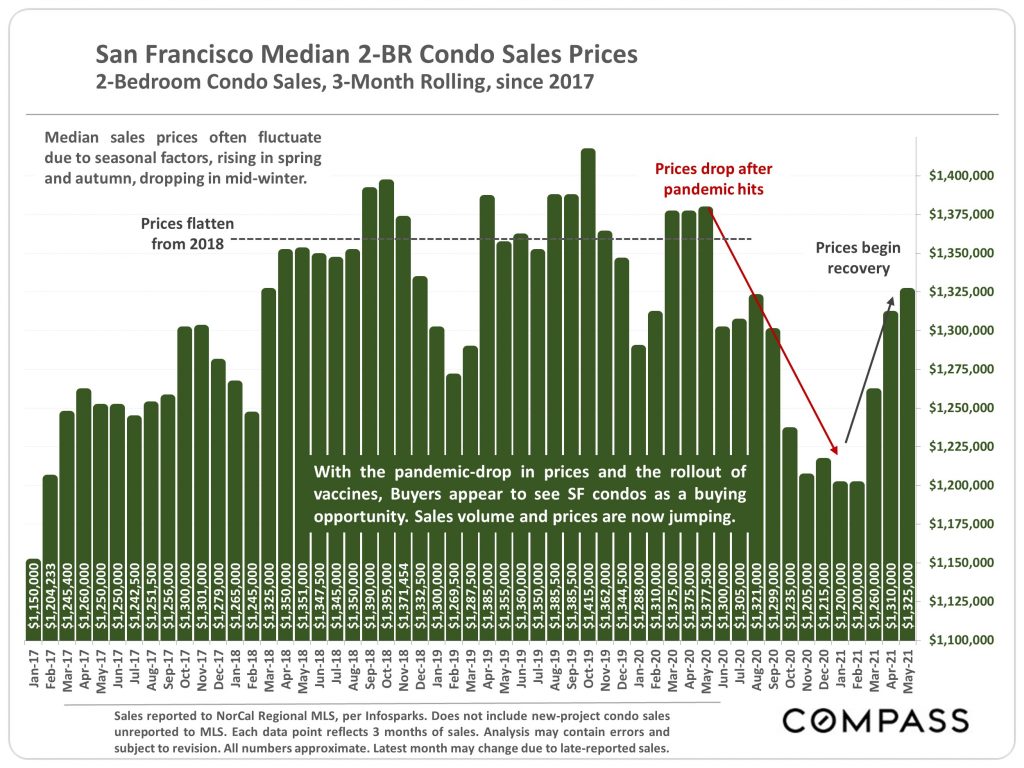

Due to a glut of listings on the market, the median sale price for a San Francisco 2-bedroom condo fell sharply during 2020. In 2021, demand, sales volume, and median price have made an equally sharp recovery.

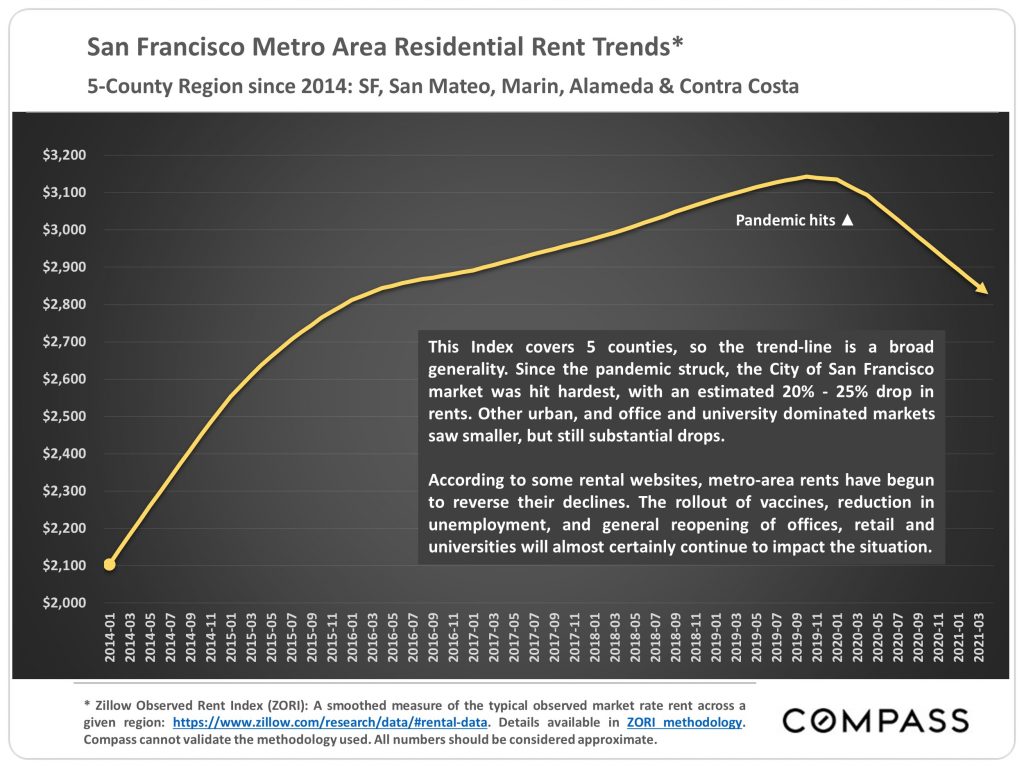

Rental websites report that rent prices are making a comeback, after falling up to 25% in some parts of San Francisco and the Bay Area.

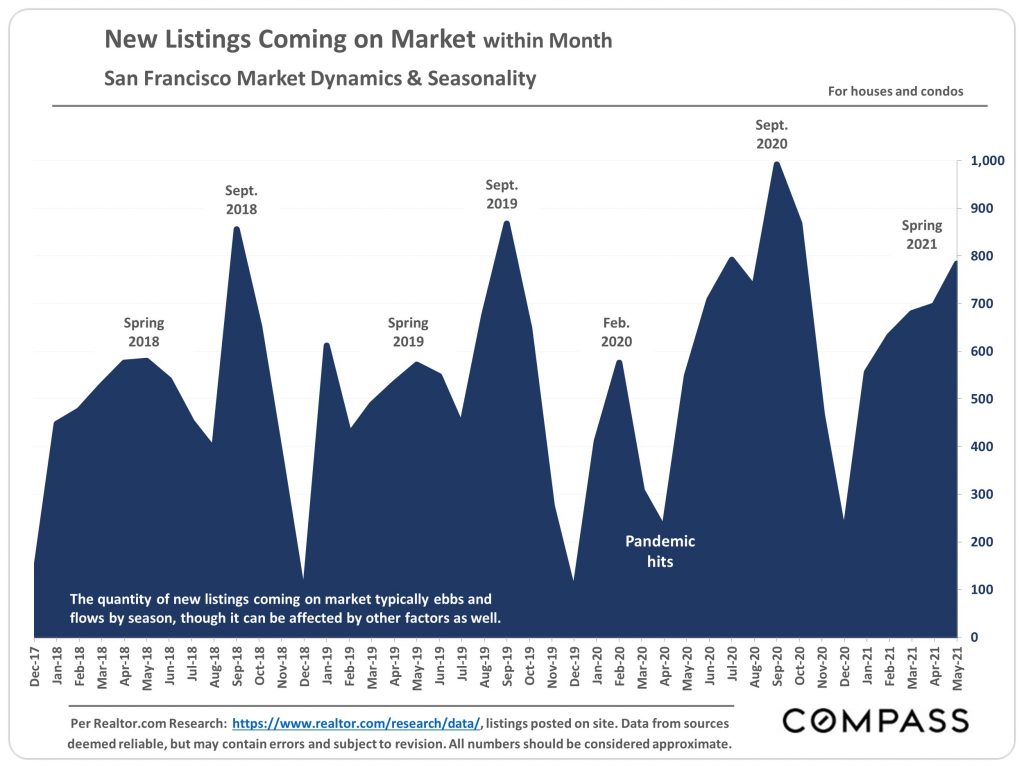

In San Francisco, the number of new listings hitting the market tends to ramp up in the spring and peak in the fall. We expect to see even more listings arrive in the fall of 2021, though hot demand may mean they are snatched up fast.

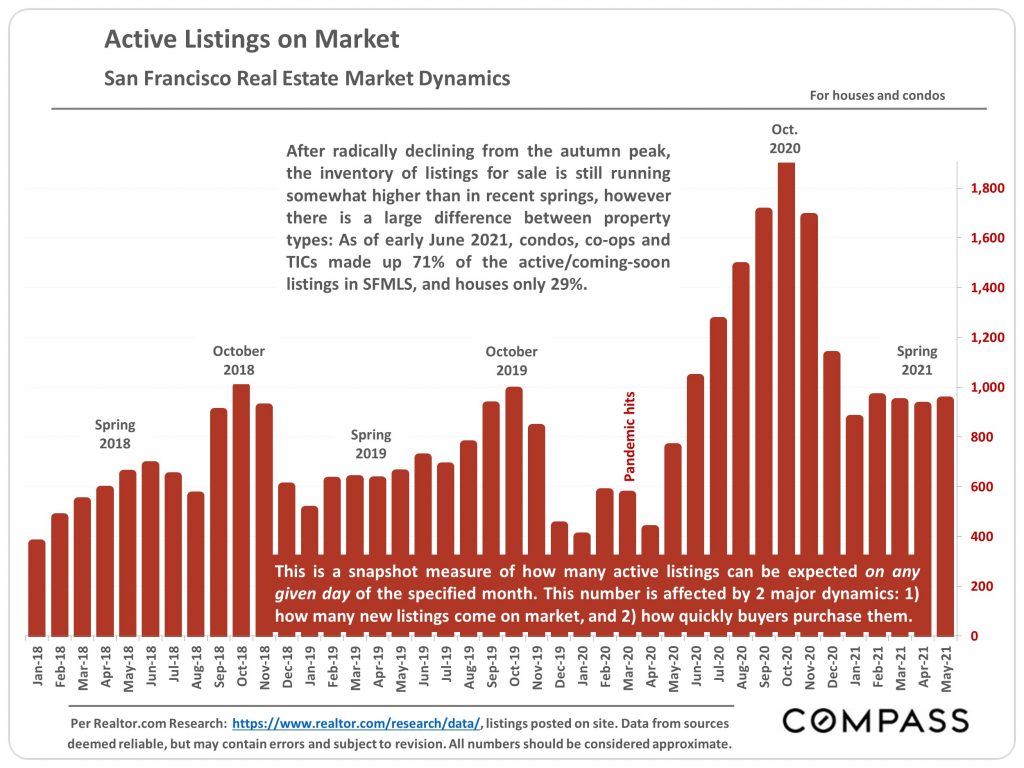

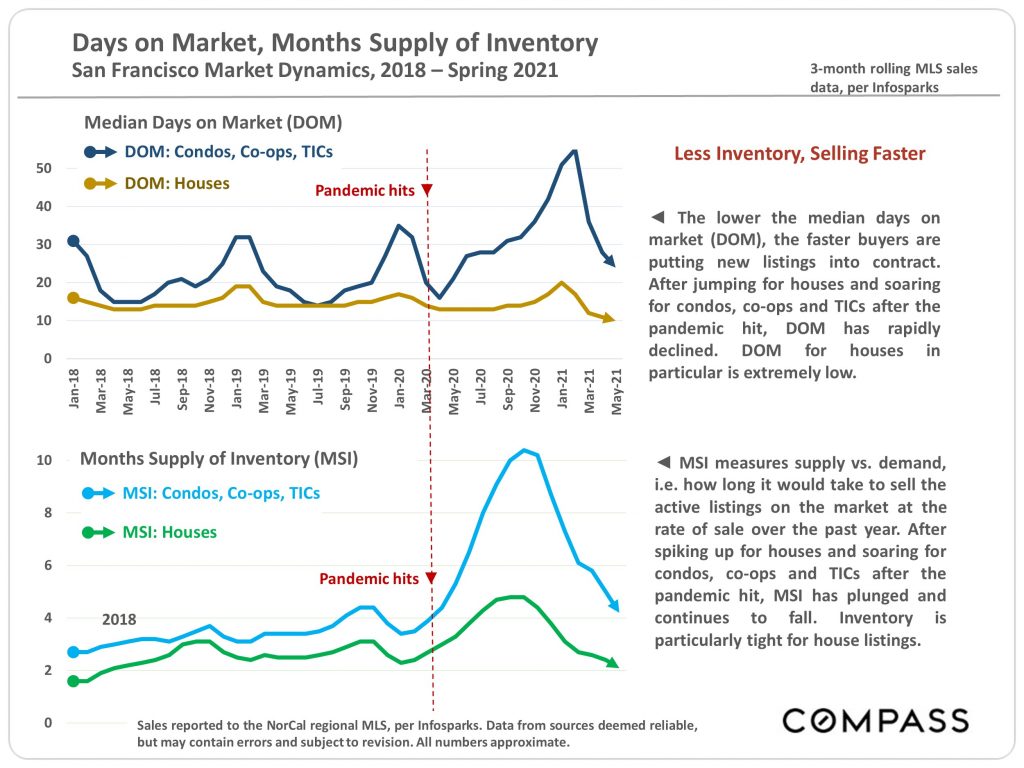

The total listings actively for sale at any time is influenced not just by how many homes are listed, but also by how fast they are purchased.

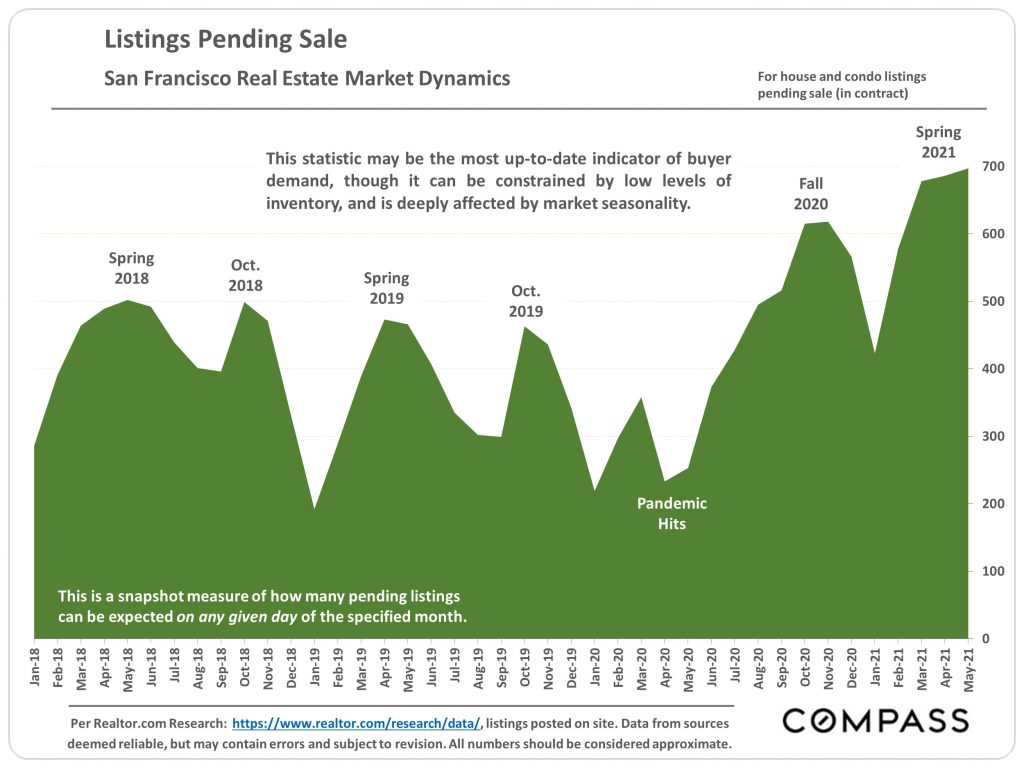

Pending sales are one of the best ways to gauge current buyer demand. After dropping off a cliff in the early days of COVID, demand has come roaring back.

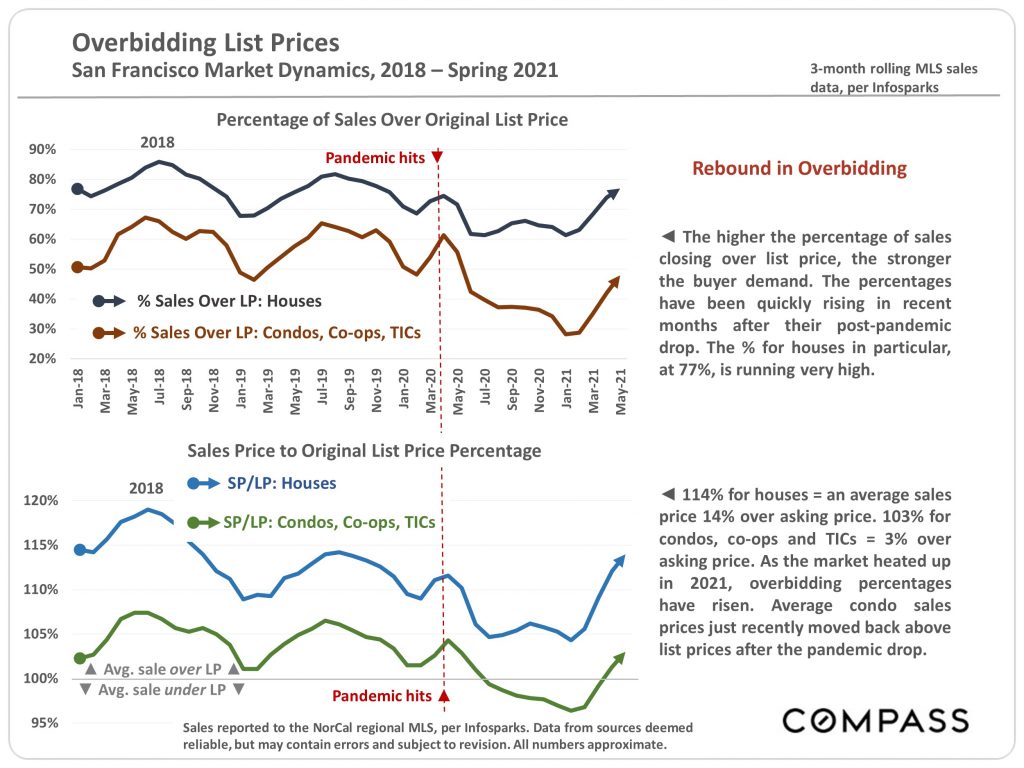

Overbidding has been common in San Francisco for years, but it became less common in 2020. Now that life is on its way back to some semblance of normalcy, overbidding is on the rebound as well.

Single-family homes are flying off the shelves, with the supply of listings at historic lows. Supply of condos has dwindled as well, after building up during mid-2020.

A review of general issues, some of which apply to Bay Area markets more than others.

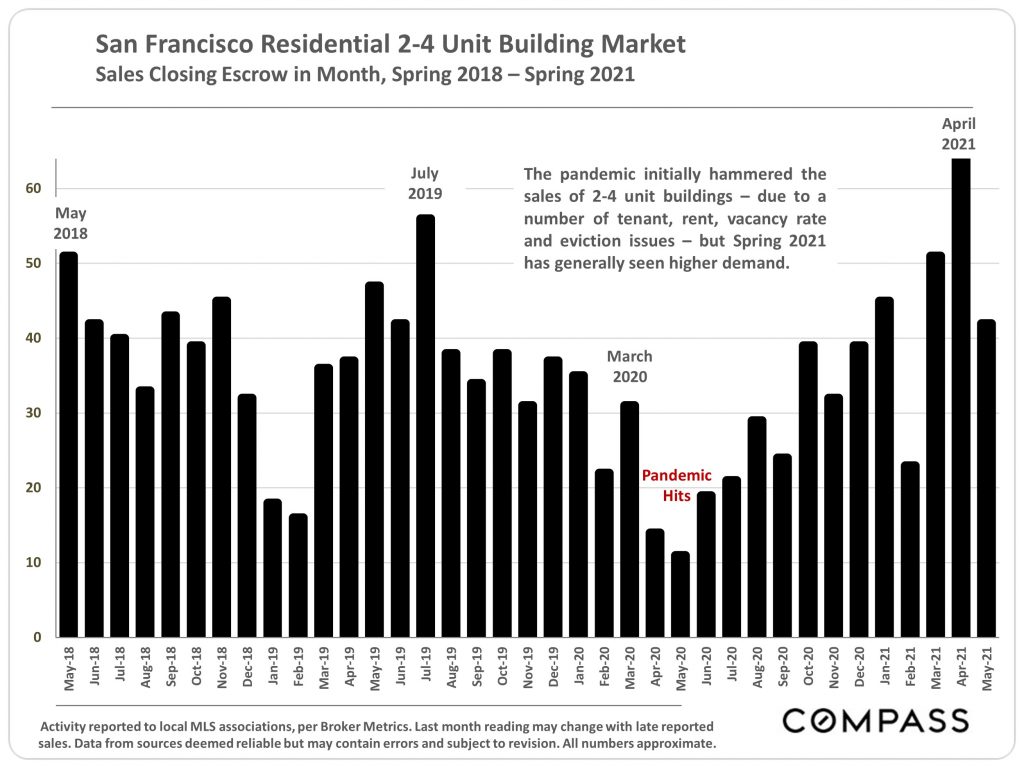

As San Francisco rents fell in 2020, so too did sales of 2-4 unit residential properties. But 2021 has seen a resurgence of demand.

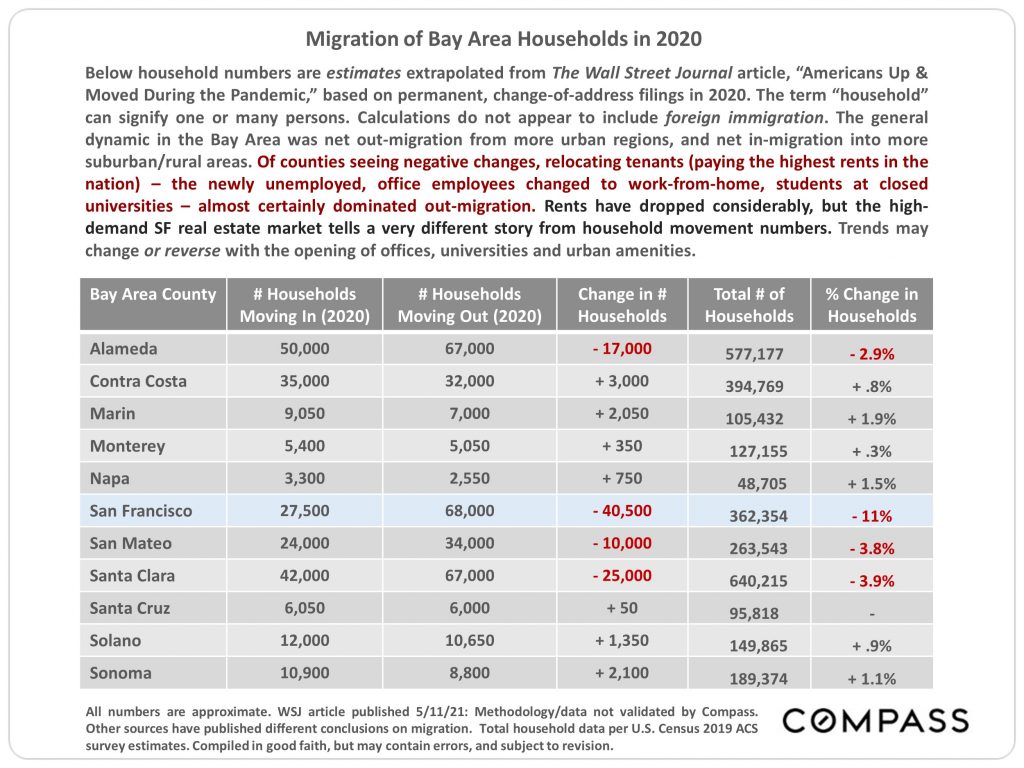

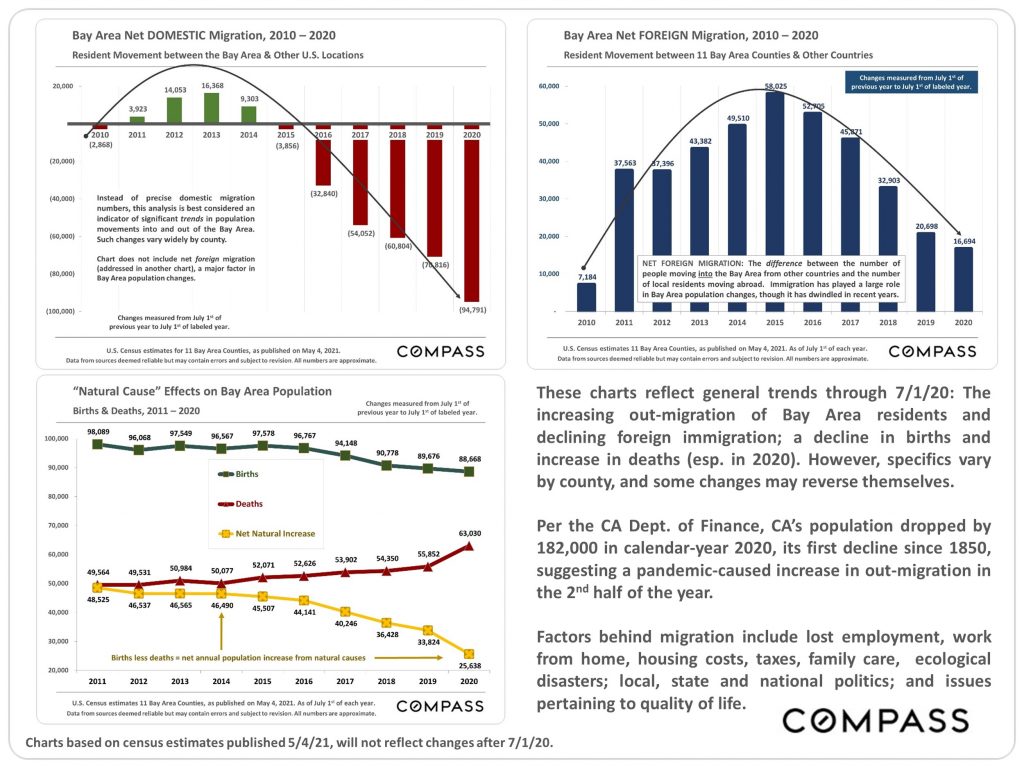

The Bay Area's net out-migration in 2020 was dominated by tenants (renters) seeking new living arrangements away from the highest rents in the county. Trends may change as reopening continues.

California's population dropped in 2020, its first yearly decline since 1850. Even before 2020, domestic and foreign migration to the Bay Area has been on a downward trend.

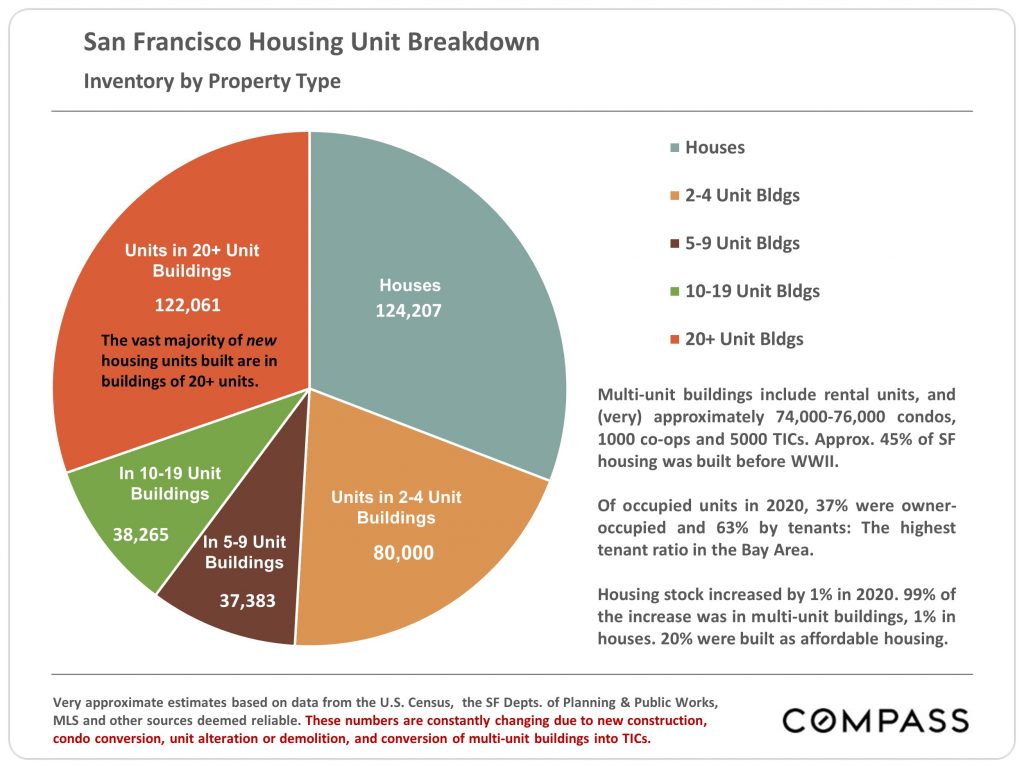

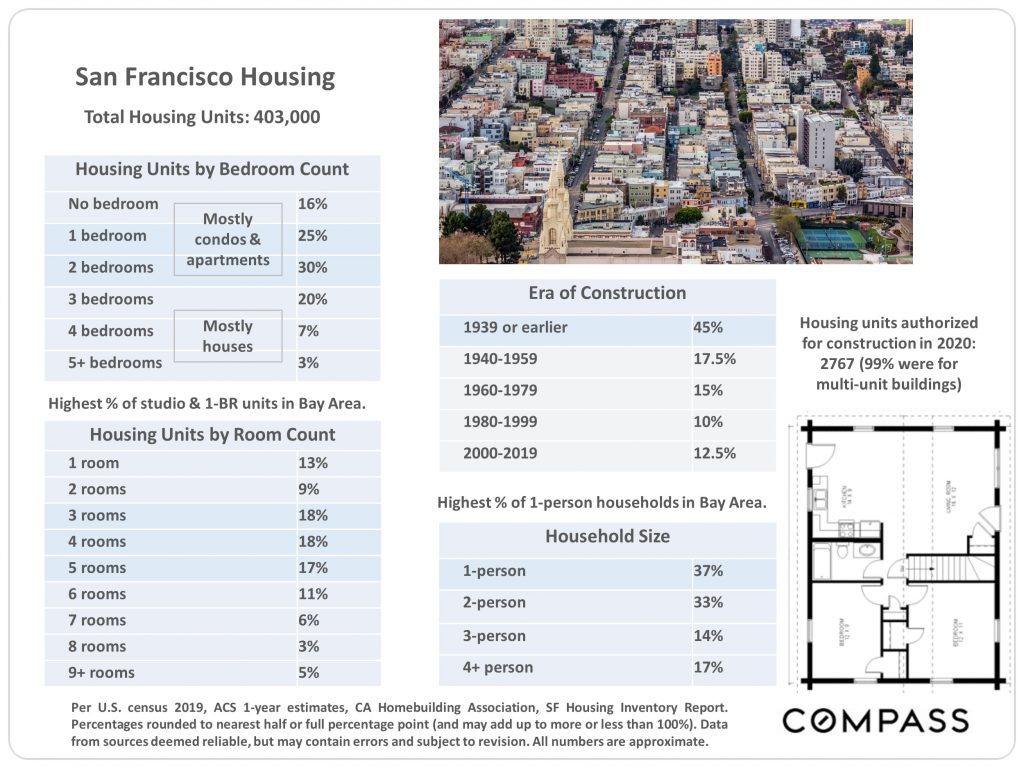

Most new housing in San Francisco is in 20+ unit buildings. Housing stock increased by 1% in 2020, and just 1% of that 1% was in single-family homes. Larger developments are better suited to grow housing stock, though a 1% yearly increase still isn't much.

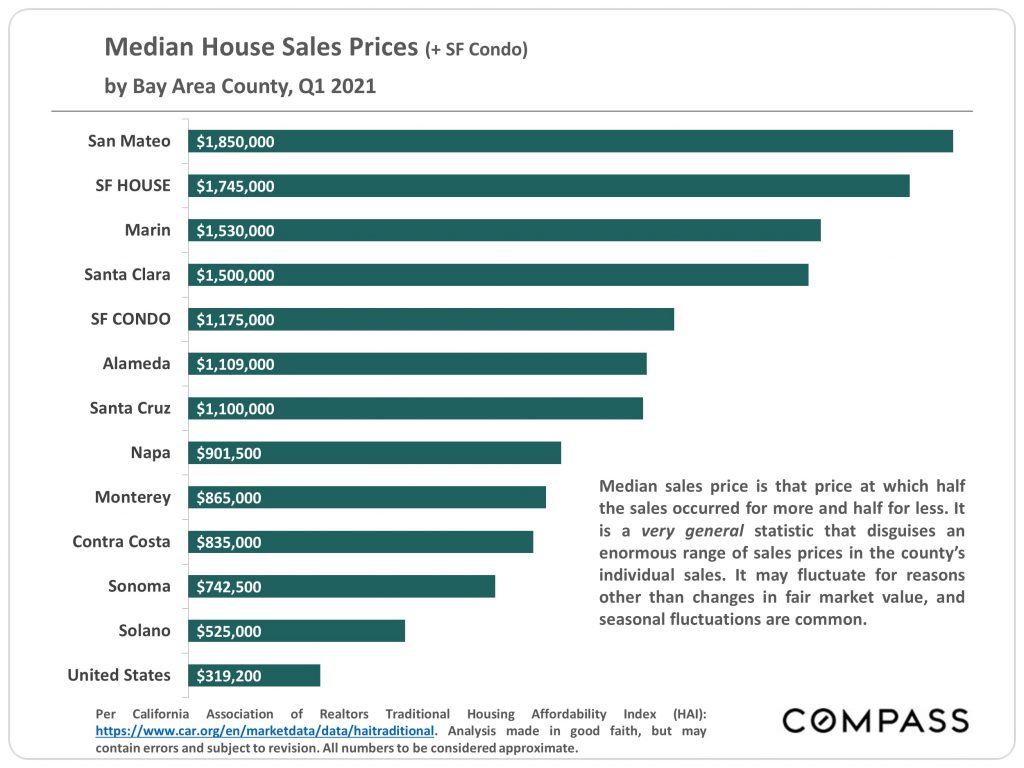

In Q1 of 2021, San Francisco single-family homes were just behind San Mateo in the highest median sale price among Bay Area counties.

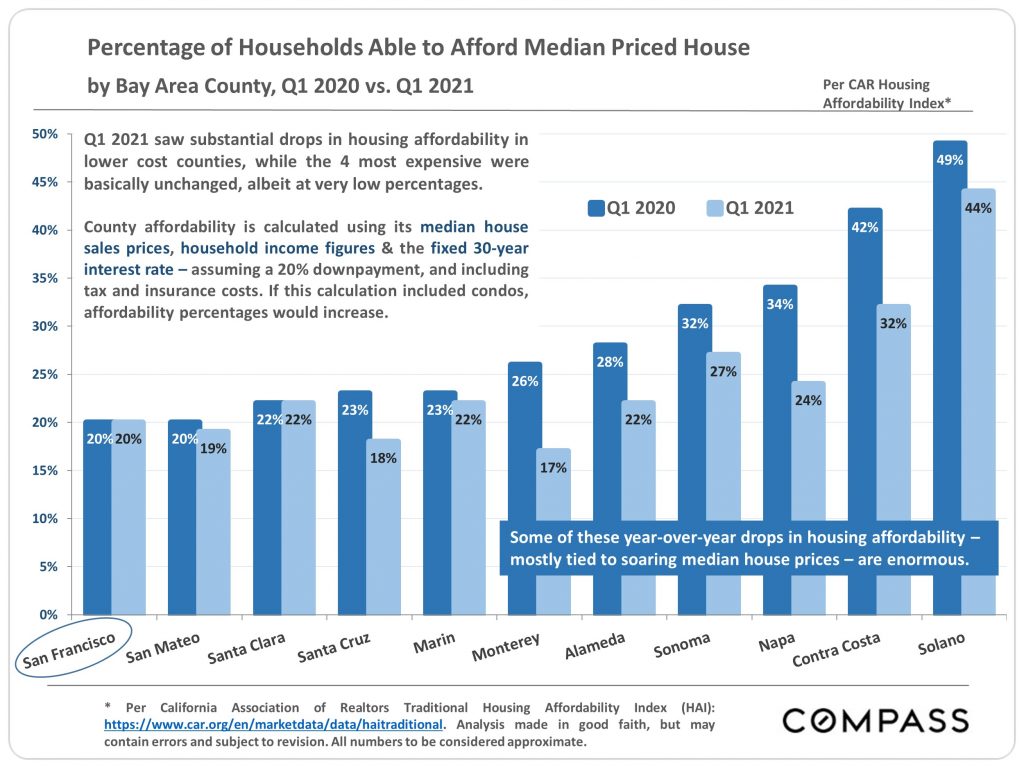

Housing became more affordable year-over-year in most Bay Area counties, save for San Francisco and Santa Clara.

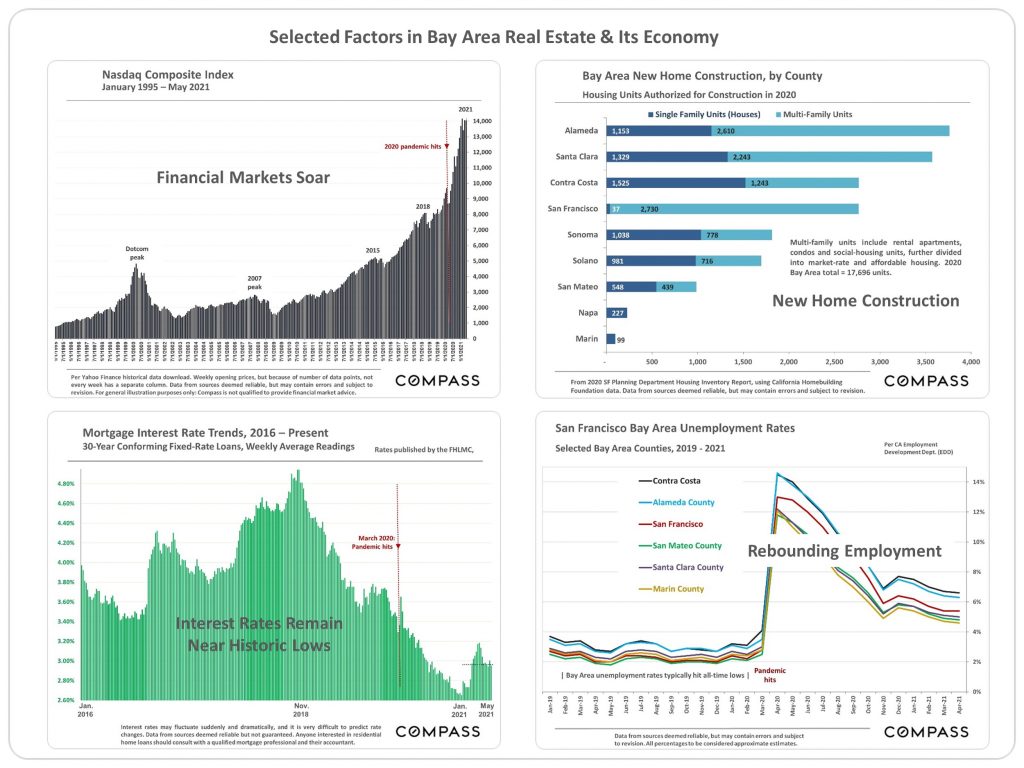

Among the factors influencing Bay Area real estate, financial markets are way up, mortgage rates are way down, and unemployment is falling.

Hopefully, this June real estate market update for San Francisco will help you in planning your real estate future.

If you have questions about the market or your next steps to buying or selling, let us know! We’re always happy to help you and anyone you send our way.

If you are thinking of selling your San Francisco property, fill out our Seller Worksheet to tell us more about your situation. If you’re looking to buy a home in San Francisco, tell us your goals and timeframe in our Buyer Worksheet. Or send us a message with any general inquiries. Have a great day!

(Footnote disclaimer: Statistics are generalities, essentially summaries of disparate data generated by dozens, hundreds or thousands of unique, individual sales. They are best seen not as precise measurements, but as broad, comparative indicators, with reasonable margins of error. Anomalous fluctuations in statistics are not uncommon, especially in smaller markets with fewer sales. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers are approximate.)