While Wall Street weathers another round of tariff drama, real estate moves at its own, steadier pace. It is known as a “stickier” asset class.

(You can’t panic-sell a house with a mouse click… and that’s probably a good thing.)

So, as headlines keep running, let’s focus on what’s actually shaping San Francisco real estate right now, and what’s likely to matter in the years ahead.

When it comes to new demographics buying San Francisco real estate, two big trends stand out:

Both are helping San Francisco home buyers overcome the hurdles of high down payments and elevated rates to get their foot in the door.

First, AI investment is giving the local market a boost. Some tech workers are using private stock sales on secondary markets to fund down payments, especially in neighborhoods close to AI hubs like Hayes Valley and Mission Bay. The result is a noticeable uptick in demand. We take a closer look on our blog:

Next-Gen SF Homebuyers: Using AI Wealth & Secondary Markets for Real Estate

At the same time, we’re witnessing the largest wealth transfer in American history. Older generations are stepping in to help younger ones buy their first homes or even investment properties together. With $84 trillion expected to change hands over the coming decades, this wave of folks buying San Francisco real estate is likely just getting started. Read more on our blog:

The Great Wealth Transfer Is Changing San Francisco Real Estate

It’s not just younger generations benefiting. Armed with significant equity, Baby Boomers have reclaimed their spot as the most active home buyers. We recently helped two older couples purchase pied-à-terre homes in San Francisco; affluent retirees from outside the city who wanted a place in SF to enjoy its culture, dining, and entertainment.

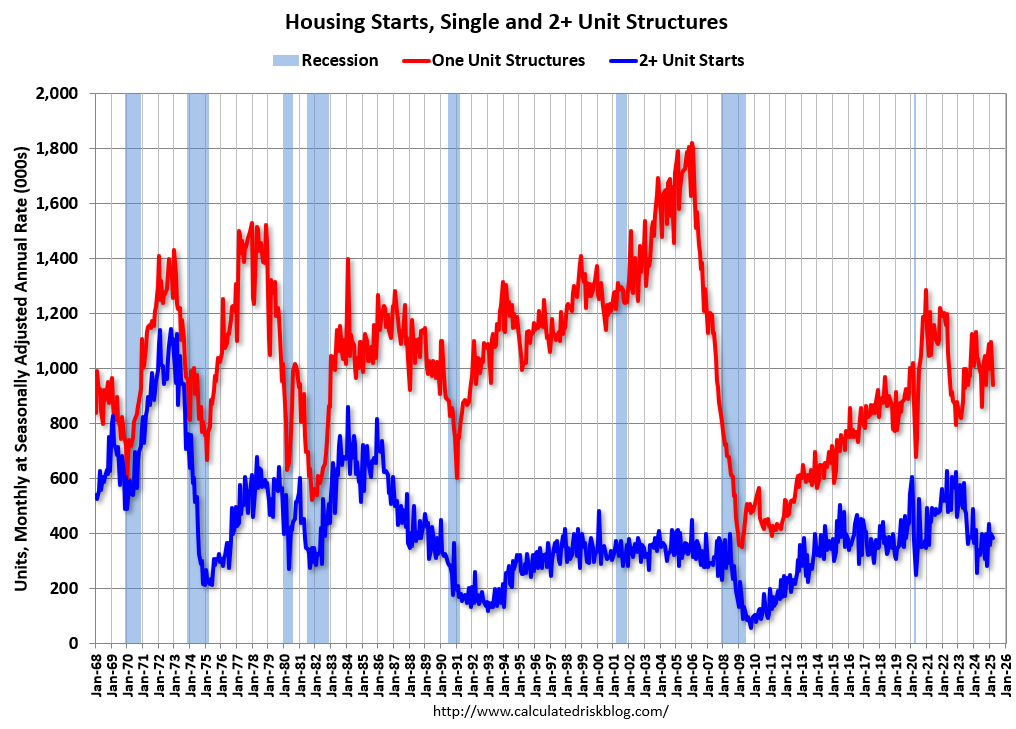

And then there’s the age-old challenge: not enough homes to go around. This chart from Calculated Risk says it all.

If you’ve ever wondered why housing feels scarce, or need a quick rebuttal for the “Blackrock’s buying everything!” crowd, here’s your answer. We simply didn’t build enough homes for a decade after 2008. Now, higher interest rates, tariffs, and inflation are slowing things down again.

In a city like ours, where land is scarce and building is tough, it’s easy to see why buying San Francisco real estate has remained a solid long-term investment, and why those with the means to buy, or family to support them, are jumping in.

Thanks for reading. If you’re curious how these trends might impact your own plans, or just want to talk through your real estate goals, we’re always here to help you or anyone you send our way.

The following stories were shared in our San Francisco real estate newsletter. Get updates and top agent tips delivered straight to your inbox—sign up today!

Ready to explore the neighborhoods around SF? Here are a few we think you’ll love.

Looking for a trusted team to help you buy and/or sell a home in San Francisco? Reach out to us today. We'd love to help.